Results at a glance:

|

Australian farmers are increasingly optimistic about the year ahead, with much of this riding on positive sentiment sweeping the sheep and beef sectors, as graziers fetch historically high prices for lamb, mutton, wool and beef – the latest quarterly Rabobank Rural Confidence Survey has found.

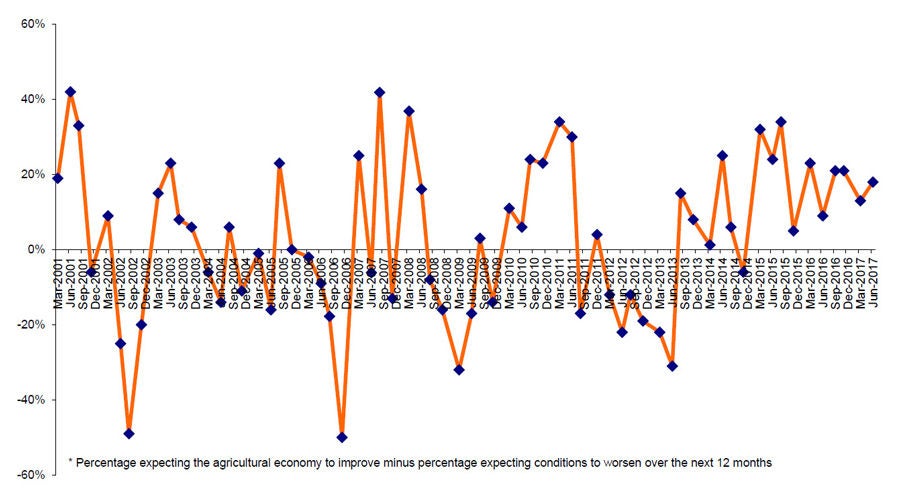

The price outlook for dairy and cotton also underpinned the optimism prevailing across Australia’s agri sector, with overall net confidence remaining at positive levels (with more farmers positive than negative) since early 2015. This is the longest period of positive sentiment in the survey’s history.

Meanwhile confidence remained relatively subdued in the grains sector, as pricing woes were compounded by the variable start to the winter cropping season – with planting rains falling short in Western Australia, South Australia and Queensland.

The survey, completed last month, found 28 per cent of the nation’s farmers were expecting conditions in the agricultural economy to improve in the coming 12 months (up slightly from 25 per cent with that view in the previous survey), while 59 per cent were expecting conditions to remain stable – the same reading as last quarter. Those with a pessimistic view of the year ahead stood at just 10 per cent.

Overall, commodity prices remained the biggest driver of prevailing optimism, with 77 per cent of surveyed farmers expecting conditions to improve citing rising commodity prices as reason for their positive outlook – up from 74 per cent in the previous survey.

Rabobank national manager Country Banking Australia Todd Charteris said prices were a particularly strong driver of the bullish sentiment in the sheep and beef sectors, reported by 85 per cent and 83 per cent of sheep and beef graziers, respectively.

“There has rarely been a better time to be a grazier,” he said, “with prices for beef, lamb and mutton continuing to hit new records, and wool prices also at an historical high – albeit back down from its recent peak.”

Mr Charteris said while dairy farmers were also buoyed by their price outlook for the upcoming season, on-farm cash flow is expected to remain tight for the next few months.

Cotton producers were also increasingly upbeat about their prospects.

“Strong price prospects – pegged to remain above $520 per bale in 2017/18 –together with good water availability is shoring up confidence in the cotton sector,” he said.

Unsurprisingly, Mr Charteris said, grain growers were the least bullish about prices, with any support for local wheat prices expected to come from an anticipated softening of the Australian dollar, rather than a shift in global fundamentals.

“As such, we are seeing prices play a part in crop rotations, with an increase in the area planted to canola and pulses, particularly chickpeas and lentils, at the expense of barley and oats,” he said.

Mr Charteris said the season was also stymying confidence in the grains sector, with planting rains falling short in many regions including parts of Western Australia and Queensland, the Eyre Peninsula in South Australia and also northern New South Wales.

“In contrast, the season has got off to a flying start in Victoria as well as the Riverina region of New South Wales,” he said.

Overall seasonal conditions were reported as a positive driver of confidence by 36 per cent of Australian farmers, up slightly from 31 per cent last quarter.

Uptake of sensor technologies

This quarter, the survey also questioned Australian farmers for the first time about their uptake and use of sensor technology, such as drones, moisture probes, yield mapping, EID (electronic identification) and auto drafting.

Mr Charteris said although the uptake of sensor technologies was found to be relatively low to date (at 23 per cent of all farmers surveyed) – its usage was much higher (at 57 per cent) in larger farming businesses with gross incomes above $1 million.

“While sensor technologies are increasingly being used and talked about, particularly yield mapping in the cropping sector, there is still a long way to go,” he said. “For many, the uptake is being hindered by the cost of the technology compared with the benefits for both productivity and profitability.”

Farm business performance

While confidence in Australia’s agri sector increased this quarter, farmers were slightly less optimistic about expectations for their own gross farm incomes in the 2017/18 financial year.

Overall, 31 per cent of surveyed farmers expected their incomes to increase over the coming 12 months, while 48 per cent were expecting little change in their financial position. And those expecting incomes to be down stood at 19 per cent.

This was largely influenced by a significant downward revision in incomes among sugar growers, with 57 per cent expecting lower farm incomes in 2017/18 (compared with 20 per cent in the previous survey).

In contrast, dairy incomes were pegged to improve, Mr Charteris said, with 46 per cent of surveyed dairy farmers expecting a better financial result in 2017/18.

Across all commodity sectors, the survey found farmers holding robust investment plans for the coming 12 months. Overall, 27 per cent are looking to increase investment in their farm businesses, while 66 per cent are intending to maintain it at current levels.

Mr Charteris said investment was pegged to be particularly strong in the cotton sector, with 36 per cent of cotton producers looking to increase investment over the coming 12 months. While it was also high amongst sheep and beef producers, with expansionary intentions held by 29 and 27 per cent of graziers, respectively.

States

Across the country, confidence was reported to be strongest in Victoria, Tasmania and New South Wales.

Largely underpinned by the bullish outlook held by graziers, Mr Charteris said those in the south-eastern states were also buoyed by seasonal conditions – particularly in Victoria and southern New South Wales. “Widespread autumn rainfall has seen the cropping season get off to a flying start in Victoria and southern New South Wales, however the north of the state needs rain to fulfil planting intentions,” he said.

Meanwhile Queensland reported the largest upswing in confidence, Mr Charteris said, largely due to the strong market fundamentals for cotton and beef.

In the major grain-growing states of Western Australia and South Australia, confidence was hindered by the subdued sentiment in the grains sector – primarily in relation to price, but also the season.

“It has been a pretty dry start to the growing season in the Western Australian wheatbelt, while South Australia has had a pretty good start, except for the Eyre Peninsula where it remains very dry,” he said.

Sectors

Across the surveyed commodity sectors, farmers were ‘on the whole’ more positive than negative about their prospects for 2017 – with a greater number of farmers expecting conditions in the agricultural economy to improve rather than deteriorate. Sugar was the exception however, with confidence edging into negative territory.

Mr Charteris said although the sentiment for each commodity sector had primarily been driven by commodity prices this quarter, seasonal conditions were also at play.

“In the sugar sector, confidence has taken a hit with the fall in the sugar price to around 460AUD/tonne, while those in Proserpine and Mackay are waiting to see how cyclone Debbie has impacted their yield,” he said.

In contrast, confidence in the dairy sector rose to its highest level in three years, to record the strongest net confidence reading across the sectors.

“Good pricing signals for the upcoming season is helping to restore confidence in the sector, and the expectation of a return to profitability for dairy farmers in the southern export region is also being underpinned by good on-farm supplies of home-grown feed and fodder,” Mr Charteris said.

Meanwhile beef and sheep producers remained bullish about their prospects, with both sectors reporting strong sentiment since early 2015.

“Not only are prices good, but low fodder prices are allowing graziers to hold onto livestock for longer than usual, which could see meat prices sustained at high levels throughout winter,” he said.

Mr Charteris said the prospect of profitable cotton prices for the upcoming 2017/18 season drove the upswing in confidence in the cotton sector, while sentiment levels in grains remained relatively unchanged, as low wheat and barley prices continued to overhang the sector.

“While we are forecasting the area planted to winter crop to remain in line with last year at just over 22 million hectares, production will all hinge on how the season pans out,” he said. “And there is downside risk, with the Australian Bureau of Meteorology rating the chances of an El Niño event occurring in 2017 at about 50 per cent – which in past events, has been associated with below-average rainfall across New South Wales, Queensland and Victoria.”

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in September 2017.

Rabobank Australia & New Zealand Group is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has nearly 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of approximately 8.6 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 94 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank's Rural Confidence Survey, please contact:

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia & New Zealand

Phone: 02 4855 1111 or 0418 216 103

Email: skye.ward@rabobank.com