Results at a glance:

|

Dry winter weather in many parts of the country has seen Australian farmer confidence decline to a four-year low, the latest quarterly Rabobank Rural Confidence Survey has found.

With much of Australia experiencing an exceptionally dry winter – officially the second-driest June on record – and the winter crop forecast slashed, seasonal conditions were shown to be weighing heavily on the minds of the nation’s agricultural producers as they looked to the year ahead.

The ‘dry’, however, did little to dent the longer-term positive outlook in Australia’s agri sector, with farmers’ investment intentions remaining strong and the viability indicator near a 14-year high – with 95 per cent of the nation’s farmers viewing their business as having long-term viability.

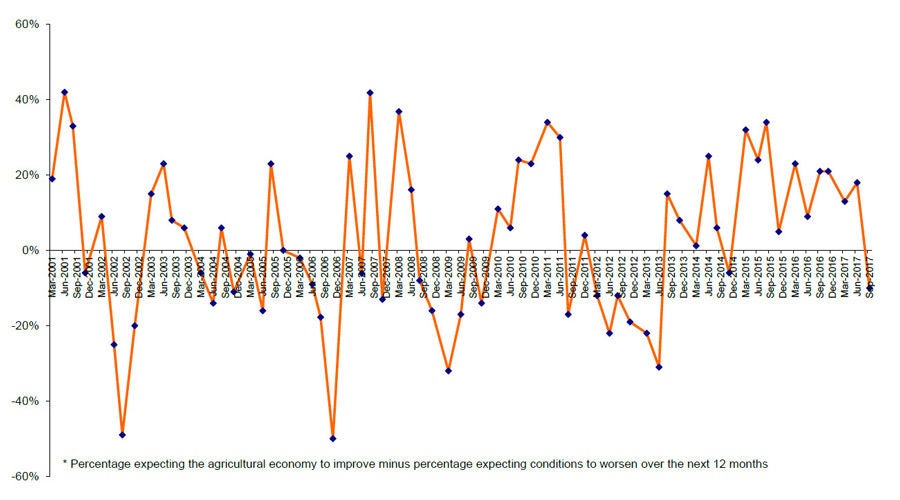

The latest survey, completed last month, found the percentage of farmers expecting the agricultural economy to worsen over the coming 12 months had increased to 27 per cent, from 10 per cent in the previous survey. Those with a positive outlook on the agricultural economy fell to 17 per cent, from 28 per cent. Around half of the respondents (51 per cent) were expecting similar conditions to the previous 12 months.

Rabobank national manager Country Banking Australia Todd Charteris said the decline in national rural confidence was unsurprising, coming off high levels seen over the past year and with many of the country’s farmers now entering spring with limited soil moisture reserves after an exceptionally dry winter.

“While early August rainfall provided a reprieve in some areas, conditions remain very dry in the central and northern cropping regions of Western Australia and across much of the eastern seaboard,” he said.

“Victoria is the exception however, with much of the state receiving good falls in recent weeks, and that rain band extending into southern New South Wales and the north of Tasmania.”

Mr Charteris said while the survey showed farmers had lowered their expectations of the year ahead, they remained resoundingly positive about the longer-term outlook for the agri sector, as reflected by strong investment intentions and views on business viability.

With the season front of mind for many, 50 per cent of farmers nominated dry conditions as a major reason conditions were likely to deteriorate over the next 12 months – nearly double the 28 per cent with that view last quarter.

Concerns around the dry season were particularly heightened in the cropping sector, with 76 per cent of grain producers with a negative outlook blaming seasonal conditions.

“The dry winter has downgraded winter crop prospects, and we are now forecasting a national wheat crop in the vicinity of 22 million tonnes, well down on last season’s 35 million tonne record,” Mr Charteris said. “However, should the forecast for dryer and warmer temperatures be realised in the next few weeks, crop production will likely be cut further.”

The dry seasonal conditions also saw confidence wane in the beef and, to a lesser extent, sheep sectors.

“The lack of rain is dampening restocker demand and has also resulted in a flush of cattle come onto the market a little earlier than expected. This has seen saleyard prices, particularly for cattle, come off their recent highs,” Mr Charteris said.

“That said, prices for beef and sheep are still well above their five-year average, and wool is trading at record levels, so the pull-back in sentiment is largely a reflection of the drier conditions and an easing of the very high confidence levels previously seen in the meat sectors.”

Across the agri sector, the outlook for commodity prices was mixed, with 44 per cent citing the market outlook as the reason conditions were likely to deteriorate in the coming 12 months. Sugar producers were the most pessimistic about the outlook for the market, with prices nominated by 78 per cent of cane growers expecting conditions to worsen.

Farm business performance

The latest survey found 44 per cent of the nation’s farmers retained a stable outlook for their gross farm incomes in the 2017/18 financial year, however more farmers were expecting lower farm incomes than last survey (29 per cent, up from 19 per cent the previous quarter). The number of farmers expecting a higher gross farm income also declined to 25 per cent of respondents, down from 31 per cent.

Across the agri sector, Mr Charteris said indicators of the longer-term outlook remained positive, with 91 per cent of the nation’s farmers looking to increase or maintain the level of investment in their farm businesses over the next 12 months. Of those, farmers looking to increase investment had wound back slightly to 22 per cent (from 27 per cent last quarter), with the number of farmers planning to maintain investment levels rising slightly to 69 per cent (from 66 per cent).

The viability index, which measures farmers’ perception of their own business viability, remained near its 14-year high, with 95 per cent of farmers across the country indicating long-term viability – with this indicator increasing to 98 per cent of businesses with an annual gross income above $300,000.

States

Across the country, confidence was down in all states, with the biggest falls reported in Tasmania, New South Wales and Queensland.

Mr Charteris said the dry winter had taken its toll on farmer sentiment across much of the country.

“Much of Queensland remains in the grip of drought,” he said, “while most of central and northern New South Wales has endured one of its driest winters on record.

“Conditions also remain very dry in the south of Tasmania and through the Midlands region, however northern Tasmania had benefited from good August rainfall.”

In the major grain-growing states of Western Australia and South Australia, Mr Charteris said, the variable start to the cropping season had seen confidence come off.

“The rainfall has been pretty patchy in Western Australia, with the northern areas of the cropping zone enduring an exceptionally dry season, while recent rains in the southern areas have lifted yield expectations to average if not better than average,” he said.

In South Australia, Mr Charteris said, sentiment was dragged down by below-average harvest prospects, particularly in the Eyre Peninsula.

“In contrast, good August rainfall has seen Victoria buck the trend as the only state on track to produce an above-average crop,” he said.

Sectors

Farmer confidence levels declined across all surveyed commodity sectors, with dairy the only sector to report ‘net’ positive sentiment (with a greater number of farmers expecting conditions in the agricultural economy to improve rather than deteriorate). Confidence in sheep and grains lagged dairy, but was comparatively stronger than in other commodity sectors.

“For dairy, the positive sentiment prevailing in the sector is primarily a ‘price story’, with this season’s southern farmgate milk price expected to see improved on-farm profitability,” Mr Charteris said, “but August rainfall in some key dairy regions has also buoyed the outlook.”

In the grains sector, Mr Charteris said seasonal conditions were dictating sentiment, with production prospects extremely variable across the country.

“Overall, the dry winter has slashed forecast production, which is now expected to be down on the five-year average, but rain over the next few weeks will be critical to curtailing any further downgrades,” he said.

Mr Charteris said the dry winter had also seen confidence in the cotton sector fall, with dryland hectares for the 2018 crop expected to be well down on last year.

“However water allocations for irrigated cotton are expected to be reasonable in a number of valleys,” he said, “with water storages at similar levels to this time last year.”

In the sugar sector, Mr Charteris said, the dry weather had been a positive, aiding harvest efforts, with the drop in cane grower confidence due to weaker sugar prices.

“After hitting a four-year high last October, international sugar prices have dropped by around 40 per cent and now sit under AUD 400/tonne,” he said. “And there is limited upside to the price outlook with the forecast global sugar surplus in 2017/18.”

In the livestock sector, Mr Charteris said, confidence had come-off its recent highs, particularly in beef.

“The lack of rain and frost events have seen graziers enter winter with limited pasture reserves, while stock prices have also come off their recent highs, albeit to remain well-above their five-year averages,” he said.

Mr Charteris said wool had been the ‘stand-out’ performer, with the Eastern Market Indicator closing the 2016/17 season at its highest close, and prices continued to break records despite the strong offering of wool when the market resumed after the recess.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in December 2017.

Rabobank Australia & New Zealand Group is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has nearly 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of approximately 8.6 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 94 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank's Rural Confidence Survey, please contact:

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia & New Zealand

Phone: 02 4855 1111 or 0418 216 103

Email: skye.ward@rabobank.com