Aussie farmers start year with optimism, but hot summer takes some heat out of confidence

Results at a glance:

|

The hot summer has ‘taken some of the heat’ out of farmer confidence, however sentiment in Australia’s agri sector remains strong as farmers look to a positive year ahead – the latest quarterly Rabobank Rural Confidence Survey has shown.

The survey found while rural confidence eased back from the highs seen at the end of 2016, strong market fundamentals for most commodities continued to underpin a largely positive outlook prevailing among the nation’s farmers.

By sector, sheep graziers were the most bullish about their prospects, with sentiment rising further with a recent upswing in wool prices. Dairy farmers posted the largest turnaround in confidence, to levels last seen in mid-2014, as farmgate margins look set to improve throughout the year.

The survey did, however, report some uncertainty in the medium-term outlook, with almost a third of farmers reporting concern the new US administration may negatively impact Australian agriculture.

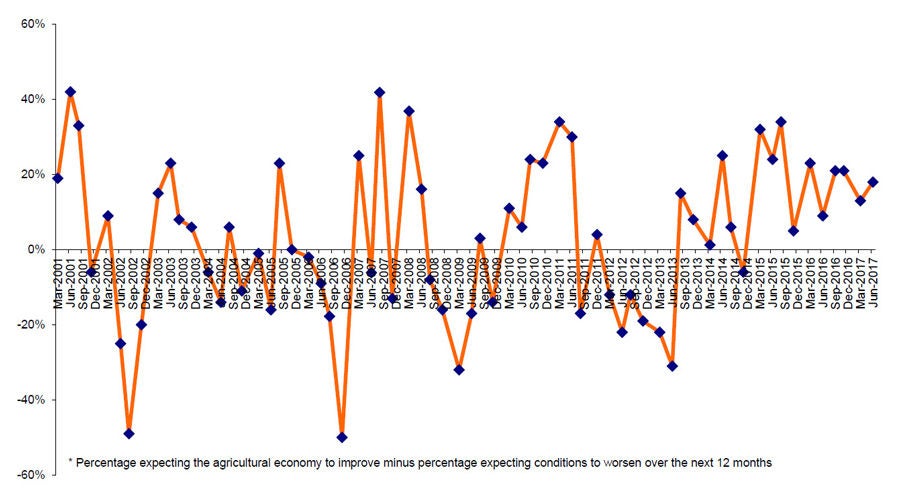

As the first gauge of rural confidence for 2017, the survey found that while the net confidence indicator eased this quarter, the majority of farmers expect the agricultural economy to remain stable. A total of 59 per cent expected the agricultural economy to perform at similar levels to last year in the 12 months ahead.

While the percentage of farmers expecting the agricultural economy to improve in the next 12 months dipped to 25 per cent (from 36 per cent last quarter), fewer farmers also reported having a negative view – with 12 per cent expecting conditions in the agricultural economy to worsen (compared with 15 per cent previously).

Rabobank national manager Country Banking Australia Todd Charteris said while the hot summer in eastern Australia had driven the pull-back in confidence, the nation’s farmers were poised for a good year, with the farmgate prices of most livestock and crops expected to come in above their five-year average in 2017.

This was reflected in the survey results, with 74 per cent of those expecting conditions to improve citing the commodity price outlook as reason for their optimism.

“The stars have really aligned for those in the livestock industry – and have for some time now – with sheep and cattle still fetching strong prices in the saleyards, while many entered summer with a good availability of feed and water,” he said.

“Wool prices have also risen strongly in recent months, particularly at the finer-end of the market, which has seen some renewed confidence in the industry.”

Mr Charteris said the large turnaround in confidence posted by dairy farmers this quarter had been driven by the improved expectations for the sector. “Farmgate prices for southern export-orientated dairy farmers are expected to increase in 2017/18, while producers in the fresh milk market are anticipating prices to remain stable at relatively elevated levels,” he said.

With cotton and sugar markets also expected to remain relatively well-supported by global fundamentals, Mr Charteris said, grains and oilseeds were proving to be the exception, particularly wheat.

“The wheat market continues to face strong headwinds, with the sheer abundance of wheat on the global market expected to mute potential price improvement this year,” he said.

Reflecting the hot summer across much of south-east Australia, seasonal conditions were less of a positive driver of sentiment among farmers this quarter – nominated as reason for optimism by 31 per cent of those expecting conditions to improve, down from 68 per cent last survey.

“Much of New South Wales, southern Queensland, South Australia and parts of northern Victoria sweltered through one of their hottest – and in some areas hottest –summers on record,” Mr Charteris said.

“And this particularly took its toll on the cotton sector, with the hot weather impacting dryland cotton yields.”

In the west of the country “it is a different story however”, Mr Charteris said, with wet conditions across much of WA’s agricultural region during February providing significant stored moisture for the state’s 2017 grains crop.

While the Rabobank survey found Australian farmers to be generally positive about the outlook for 2017, the results highlighted some uncertainty stemming from the recent change in US government. A total of 30 per cent of farmers surveyed reported having concerns the new Trump administration may have a negative impact on Australian agriculture, particularly on trade relations with the US.

“Although it is too early to assess the impact of the Trump presidency on Australia’s agri sector, it is clear the administration change in the US is providing some uncertainty in the near-term and potentially some turbulence in the medium-term on economic and regulatory fronts,” Mr Charteris said.

Farm business performance

While the overall net rural confidence reading eased back this quarter, Australian farmers overall retained a positive outlook for their gross farm incomes. A total of 32 per cent reported that they expect an improved financial result this year, while a further 50 per cent expect similar incomes to 2016.

By commodity however, expectations were varied – and in some cases – vastly different from last quarter. Dairy farmers reported anticipating a significant improvement in farm incomes, albeit from a low base, while income projections were also pegged higher in the sheep sector.

In contrast, cotton and sugar growers and – to a much lesser degree – beef and grain producers revised down income projections.

Reflecting ongoing longer-term confidence in the agri sector, investment intentions rose to a two-year high, with 27 per cent of the nation’s farmers looking to increase their farm business investment, up from 23 per cent previously. While a further 66 per cent were intending to maintain their investment in-line with last year.

Investment in on-farm infrastructure remained a key priority, while farmers were also looking to upgrade plant and machinery, increase their livestock numbers and invest in new technologies.

States

Across the country, rural confidence levels eased in most states, except Tasmania and Western Australia, which both posted stronger results than last quarter.

The survey reported particularly bullish sentiment in Tasmania, while farmer confidence in Western Australia returned to positive territory, following its small dip at the end of last year.

“Last year’s record grains harvest in Western Australia is driving some of the positivity, while good February rainfall has provided significant stored moisture for the upcoming crop,” Mr Charteris said.

Although rural confidence levels overall eased in New South Wales and Victoria, the state’s sheep producers and to a lesser extent, beef producers remained upbeat, while dairy farmers reported renewed optimism in their outlook.

Rural confidence also dipped slightly in South Australia, while it took a larger hit in Queensland – with confidence in the north of the country now trailing behind the other states.

Mr Charteris said very hot summer weather in Queensland, particularly across the Darling Downs, had seen the state’s producers become increasingly cautious in their outlook for 2017, while the wet season has fallen short in the central parts of northern Queensland.

Sectors

While overall rural confidence had eased, farmers in all surveyed commodity sectors were generally more positive than negative about their prospects for 2017 – with a greater number of farmers expecting conditions in the agricultural economy to improve rather than deteriorate. The exception was cotton, where confidence levels had fallen into negative territory.

Mr Charteris said while cotton prices remained “pretty solid”, the hot dry summer has had impacted on cotton yields. “Although its real impact is unlikely to be known until harvest, the dryland plant has been struggling in the heat, while those with irrigated cotton will be spending more than they hoped on inputs,” he said.

Staging the strongest turnaround in confidence, sentiment in the dairy sector rose to its highest level since mid-2014.

“Although much of the benefit of improved farmgate pricing is set to come next season, most dairy farmers have access to a good supply of home-grown feed and irrigation water, which should assist the return of profitability to the sector,” Mr Charteris said.

Sheep producers were the most positive about their prospects in 2017, while confidence in the beef sector retreated from the strong levels reported in 2015 and 2016.

“The recent surge in wool prices has given sheep producers another reason to smile,” Mr Charteris said, “and lamb and beef markets remain strong, although beef prices are easing off last year’s record levels.”

Sentiment remained steady in the grains sector, he said, with much hinging on a “good early break in the season”, given there was little upside for prices.

Meanwhile the nation’s sugar growers revised down their expectations for the coming year, however the majority expect conditions to remain similar to last year.

“Although we’ve seen sugar prices pull back from the four-year highs reached in October, the fundamentals are keeping prices pretty buoyant,” Mr Charteris said.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in June 2017.

Rabobank Australia is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 115 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of approximately 8.6 million clients worldwide through a network of close to 1000 offices and branches. Rabobank Australia is one of the country's leading rural lenders and a significant provider of business and corporate banking and financial services to the Australian food and agribusiness sector. The bank has 61 branches throughout Australia.

To arrange an interview or for more information on Rabobank's Rural Confidence Survey, please contact:

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia & New Zealand

Phone: 02 4855 1111 or 0418 216 103

Email: skye.ward@rabobank.com