Results at a glance:

|

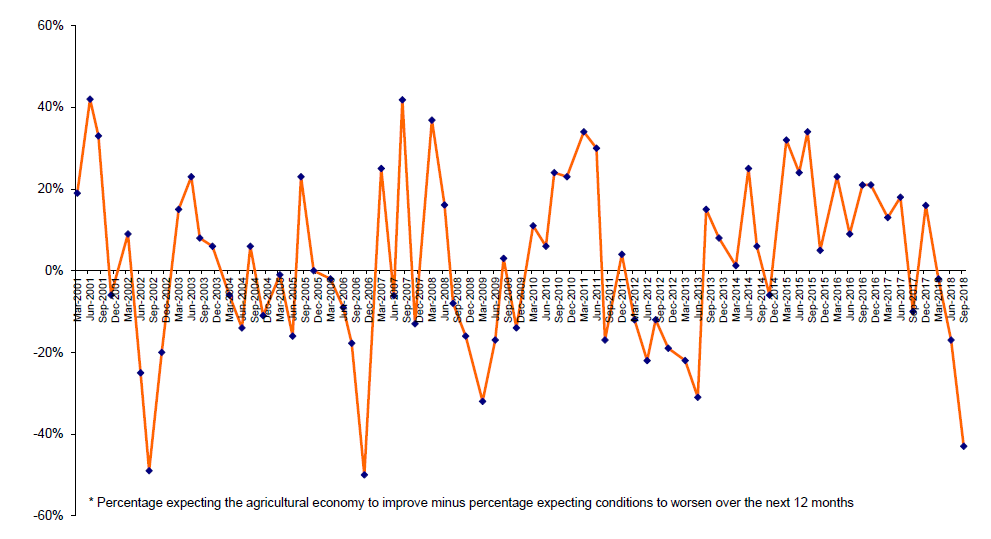

Heightened concerns over the dry weather gripping much of rural Australia has driven down confidence among the nation’s farmers to a five-year low, the latest Rabobank Rural Confidence Survey has found.

With southern Australia recording its second-lowest autumn rainfall on record, following an exceptionally hot and dry summer, seasonal conditions were cited as the key concern by 75 per cent of farmers surveyed who had a negative outlook on the coming 12 months – up from 36 per cent in March 2018.

Grain growers were particularly worried by the weather, reporting the biggest drop in sentiment in the survey, with a below-average winter crop now firmly on the cards.

While short-term confidence took a substantial knock, the nation’s farmers continued to report strong farm business viability, and at levels higher than in previous dry periods.

The survey, completed last month, found more than a third of the nation’s farmers (35 per cent), now expect agricultural economic conditions to worsen in the coming 12 months, up from 21 per cent with that expectation in March this year.

Those with a positive view on the year ahead remained relatively steady at 18 per cent (previously 19 per cent), while 41 per cent expected economic conditions to remain relatively the same.

Rabobank Australia CEO Peter Knoblanche said with the dry weather front-of-mind and much of New South Wales and Queensland facing drought conditions, it was no surprise confidence had taken a hit – albeit coming off a high base, from strong levels achieved in recent years.

“Commodity prices have been underpinning the prevailing confidence in Australia’s rural sector for much of the past five years, notwithstanding the dairy downturn and fall in sugar prices,” he said.

“The resilience of farm businesses in this tough season is evident, with the survey showing strong viability, and at levels higher than in previous dry periods. Farmers are also continuing to invest to increase business resilience with rising intentions to invest in on-farm infrastructure, including water and irrigation, and adoption of new technologies.”

With dry conditions taking the ‘front seat’, Mr Knoblanche said, 75 per cent of surveyed farmers expecting conditions to worsen over the next 12 months had cited drought as the reason for their pessimistic outlook, well outstripping other factors weighing on sentiment.

Farmers in New South Wales were particularly anxious about the season, with nine in 10 of those with a pessimistic outlook citing ‘drought’ as the reason conditions were likely to worsen.

“The majority of New South Wales is now in the grip of drought, with 63 per cent of the state in drought or drought onset, and the balance largely in drought watch, according to the DPI Combined Drought Indicator,” Mr Knoblanche said.

“Meanwhile large swathes of Queensland have been drought-declared since early 2013, with 57.4 per cent of the state remaining in drought.”

This has seen Queensland and New South Wales bear the bulk of the decline in winter crop plantings, he said, with planted hectares expected to be down by 11 and seven per cent, respectively.

In contrast, Mr Knoblanche said the “tables had turned” in Western Australia since the survey was conducted, with recent widespread rain. “Nearly all of the crop was planted into dry soil, but crops in the west will now have the chance to germinate,” he said, “and farmers will be able to finish their planting programs.”

While conditions had improved in South Australia and parts of Victoria, Mr Knoblanche said rain was critically needed to shore up crop production prospects.

Wool is king

For those Australian farmers expecting conditions to improve, commodity prices were cited by 72 per cent as key reason for their optimistic outlook, up from 61 per cent in the previous survey.

Wool producers are particularly buoyed by price prospects, Mr Knoblanche said, with the Eastern Market Indicator recently breaking through “the seemingly insurmountable 2000 cent mark”.

“There is a lot of excitement in the wool industry, with wool now delivering some of the strongest returns growers have ever seen,” he said.

Confidence in the sheep sector is now outstripping other commodity sectors, he said, with the survey showing 22 per cent of the nation’s sheep producers expect economic conditions to improve further, while 53 per cent expect a continuation of current conditions.

Farm business performance and investment

In line with the drop-off in confidence, farmers also revised down expectations fortheir own gross farm incomes in the coming 12 months. As such, 33 per cent now expect lower incomes in 2018/19 (compared with 24 per cent in the previous survey), while 45 per cent expect a similar result to the last 12 months. Those expecting incomes to increase stood at 21 per cent, down from 29 per cent.

Despite lower income projections for all commodities, except dairy, farmers across the country held strong investment intentions for the coming 12 months – althoughthe number intending to increase the level of their investment was pared back to 19 per cent of respondents, down from 25 per cent in the previous survey. The percentage expecting to maintain investment at current levels increased to 69 per cent, up from 63 per cent.

States

Across the country, sentiment was mixed, with New South Wales, Western Australia and Queensland reporting the largest drop-off in confidence to sit at five-year lows. Meanwhile confidence remained stable, albeit slightly subdued, in Victoria, but lifted and was comparatively strong in Tasmania and South Australia.

“While confidence was down in Western Australia, we would expect it now to be much higher given the recent widespread rain, and current forecasts suggest more rain on the way,” Mr Knoblanche said.

“In contrast, the latest BOM forecast suggests winter rainfall could be very much below average for a lot of eastern New South Wales, southern Queensland and northern Victoria,” he said, “which are already battling very dry conditions.”

In contrast, confidence hit an 18-month high in Tasmania, with comparatively favourable seasonal conditions and strong price prospects, particularly for dairy, feeding into positive sentiment.

Sectors

By surveyed commodity sectors, confidence was down across the board, except dairy and cotton which posted an upswing, but still lagged behind sentiment in the sheep sector.

“Despite seasonal concerns, with many in the east looking to feed sheep through winter, confidence remains strong as graziers fetch wool prices not seen since the artificially high reserve price scheme and the 1952 spike,” Mr Knoblanche said. “Meanwhile lamb and mutton prices are holding strong, but the survey found growing concern in Western Australia about potential changes to the live export industry.”

In dairy, Mr Knoblanche said milk price expectations for southern export producerswas also outweighing seasonal concerns with a full-season milk price in the ‘mid six dollars’ potentially on the cards.

“Cotton growers are also buoyed by price prospects,” he said, “with cotton prices at one of the highest levels we have seen and forward prices for next season’s crop reaching levels above $600 a bale. That said, growers are hesitant to forward sell, as water allocations are looking very tight heading into next season unless there is significant winter rain.”

Meanwhile confidence in the grain sector took the biggest hit, down from earlier season highs.

“Early indications point to a national wheat crop in the vicinity of 22.9 million tonnes, but there is considerable downside to this forecast if rains do not eventuate in the next few weeks,” he said. “The dry, however, has fed into some of the highest domestic wheat and barley prices we have seen in the past 10 years, with reduced plantings also acting as price support for canola.”

Confidence in the beef sector fell back to a five-year low, while in sugar it was back around a three-year low and lagged well behind other commodities.

“Beef confidence has fallen on the back of the ‘dry’ and increased feed requirements, but also prices,” he said, “which are above the five-year average, but are significantly down from earlier this year, particularly for lighter and younger cattle.”

In sugar, Mr Knoblanche said while the ICE#11 lifted in May, to around A$365 per tonne, record high production in India and Thailand was curbing a sustained improvement in prices.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis.

The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in September 2018.

Rabobank Australia & New Zealand Group is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has nearly 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of approximately 8.6 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 94 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank’s Rural Confidence Survey, please contact:

Media contact:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia

Phone: 02 4855 1111 or 0418 216 103

Email: skye.ward@rabobank.com