Results at a glance: • Adverse seasonal conditions – drought, floods and bushfires – have held back Australian farmer confidence in the past quarter • Rural confidence is particularly down in Queensland, as northern livestock producers face long recovery from flood damage • For drought-affected areas, particularly those in southern Australia, the outlook now hinges on an autumn break |

The start of 2019 has been characterised by ‘drought and flooding rains’, as adverse seasonal conditions keep sentiment in Australia’s agricultural sector subdued, the latest quarterly Rabobank Rural Confidence Survey has found.

Lack of drought-breaking rain in eastern and southern Australia continues to take its toll, while sentiment has plunged in Queensland as northern cattle producers come to terms with the devastation of recent flooding.

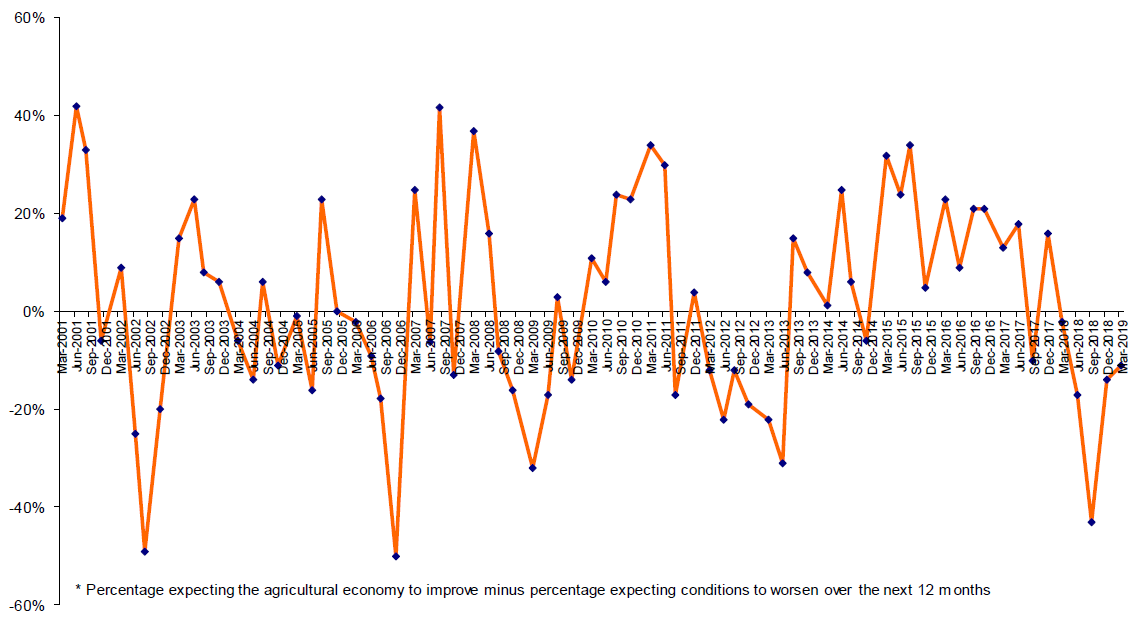

The first Rural Confidence Survey for 2019, released today, showed while overall farmer sentiment in the nation had edged marginally higher over the past quarter, it remained at low levels, with more farmers negative than positive about the year ahead.

Farmers in Western and South Australia, however, were more optimistic than their counterparts in the rest of Australia, reporting a higher level of confidence as they looked forward to a good autumn break.

Rabobank Australia CEO Peter Knoblanche said it had been a very difficult start to the year for many, with drought, bushfires and floods. And with the country enduring its warmest summer on record.

And, the outlook for the year ahead all hinged on seasonal conditions, which remained very uncertain heading into the critical autumn period, he said.

“A good autumn break will be critical to allow farmers to get their crops in on moisture and to give graziers some relief from feeding stock. And significant rains are needed to boost irrigation storages, which remain low in all major systems in south-eastern Australia,” he said.

With rain in the next few weeks critical to shoring up confidence in the season ahead, Mr Knoblanche said commodity prices, thankfully, remained strong. “Positive developments like improved access to overseas markets, such as the recent trade deal with Indonesia, and increased investment in agriculture are also helping to underpin longer-term positivity in the sector,” he said.

Mr Knoblanche said while ongoing drought conditions were still a big concern for farmers in many parts of the country, including southern and central Queensland, the devastating floods in north-west Queensland had significantly impacted farmer sentiment in that state.

“Australian farmers are very proficient at managing the vagaries of the weather, however natural disasters like the recent floods in north-west Queensland are something else entirely, and no-one can adequately prepare for these extremes,” he said. “For those north Queensland cattle producers who have endured years of drought and fought to keep their stock alive, only to lose them in the floodwaters is nothing short of devastating. While stock losses are yet to be determined, some graziers in the region have lost half, to nearly all of their cattle, making it a very long road to recovery.

“That said, there are strong, resilient operations in the area that are well positioned and supported for recovery.”

The latest quarterly survey found 33 per cent of Australian farmers expected conditions in the agricultural economy to worsen in the coming 12 months, a slight improvement on the 40 per cent with that view at the end of last year. Drought remained the primary driver of pessimistic sentiment at a national level, cited by 82 per cent as the key reason for their negative outlook.

The number of farmers who were anticipating a better year also declined slightly to 22 per cent (from 26 per cent in the previous quarter), while 39 per cent expected the agricultural economy to remain stable in the year ahead.

States

Across the country, farmer confidence was highest in Western Australia and South Australia.

“In the west, the prevailing positivity comes off 2018 being one of the most profitable years the state’s grain growers have ever experienced,” Mr Knoblanche said. “And while it will be hard for the coming season to match up, it has helped set many up for this year, and the years ahead.”

Strong grain prices also contributed to holding up a higher level of sentiment among South Australian farmers.

Victorian farmer confidence edged up for the quarter, primarily driven by anticipation of a positive autumn break.

In South Australia, Victoria and New South Wales – where last year’s winter crops were all below average and it remains dry in many regions – farmers were looking for a “decent autumn” to set them up for the year ahead, Mr Knoblanche said.

“It is perhaps the most anticipated autumn break in a long time,” he said, “coming off the back of a dry year, and in some areas, a consecutive run of dry years. Farmers are ready to jump into their cropping programs with confidence if the season allows, although it will take time to ease the input cost pressures for those feeding livestock and to rebuild herds.”

By state, Queensland reported the biggest downturn in confidence in the survey, while sentiment remained relatively subdued in New South Wales.

“Queensland is a state of two halves, with those in the north grappling with the aftermath of the floods, while in the south of the state, it has remained hot and dry, curtailing summer crop yields. In particular, the south-west and Darling Downs have remained very dry, and rain has been patchy at best in the centre of the state.” Mr Knoblanche said.

Meanwhile in Tasmania, confidence remained relatively sound despite the bushfires, which have impacted grazing country in the Highlands and also caused potential smoke taint to wine grapes in the Huon Valley and Channel region.

Sectors

The biggest upswing in confidence was reported in the grains sector, with sentiment among grain growers outstripping other commodity sectors.

“For grain growers, the winter cropping season is all ahead of them,” Mr Knoblanche said, “With local grain stocks at a 10-year low, the domestic basis is expected to stay above average into 2020, which is also helping to underpin confidence in the sector.”

Confidence was also comparatively strong among sheep graziers, with 50 per cent expecting a similar year to the last, and a further 22 per cent expecting conditions to improve.

“While the high feed costs have taken some of the shine off, lamb and wool prices remain at historically high levels,” Mr Knoblanche said. “But graziers will be hoping for a good autumn to reduce their feeding requirements, which not only takes its toll financially but also emotionally, as farmers are out there feeding their stock day-in, day-out.”

In the beef sector, he said, the magnitude of the northern Queensland floods was likely to have a flow-on effect on the cattle industry as a whole, but the full impact was still not known.

Meanwhile confidence in cotton, sugar and dairy lagged the other commodity sectors.

“With very little water at this stage going into next season, this is creating uncertainty in the cotton sector,” he said, “while in sugar, this season’s cane crop delivered exceptional sugar content but prices remain low. However, there is potential for global supply tightening which could see sugar prices appreciate marginally throughout the year.”

In dairy, Mr Knoblanche said substantial cost pressures continued to create significant headwinds for farmers.

“Feed costs are now double where they were a year ago and, for irrigators, the cost of temporary water has trebled,” he said. “So for those farmers relying on irrigation, and who haven’t had a decent spring, it is a really tough operating environment at the moment,” he said.

Farm business performance and investment

Farmers’ on-farm investment intentions remained relatively strong this survey, with nearly two-thirds of the surveyed producers (63 per cent) looking to maintain their current level of farm business investment throughout the coming 12 months, while a further 19 per cent were intending to increase investment.

Western Australia and Tasmanian farmers had a particularly strong investment appetite, with 34 per cent of farmers in both states (almost double the national average) looking to increase their investment over the coming year.

In contrast, 25 per cent of farmers in New South Wales and 21 per cent in Queensland were intending to wind back investment – reflecting seasonal challenges.

The nation’s farmers also slightly revised up expectations for their gross farm incomes in 2019. That said, 34 per cent were expecting a weaker financial result (compared with 42 per cent last quarter), while 21 per cent anticipated their incomes would improve (down slightly from 24 per cent previously). A total of 42 per cent were expecting similar incomes to last year.

Farmers in Western and South Australia were the most positive about their income projections.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis.

The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in June 2019.

Rabobank Australia & New Zealand Group is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank’s Rural Confidence Survey, please contact:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Skye Ward

Media Relations Manager

Rabobank Australia

Phone: 02 4855 1111 or 0418 216 103

Email: skye.ward@rabobank.com