Results at a glance: • Significant rain prompts major turnaround in farmer sentiment across Australia, despite ongoing effects of drought and bushfire • Farmers are confident of return to better seasons and improved farm incomes • Strong commodity prices are fuelling farmer optimism • Confidence up in all states, with most notable swings in NSW and Queensland • Survey finds nearly 70% of farmers expect climate change will impact their business in the next decade, with 20% expecting that impact to be major |

Australian farmers have stared down one of the toughest summers on record with rural sentiment bouncing back to its highest level in nearly five years, according to the latest Rabobank Rural Confidence Survey.

The survey results, released today, reveal late-summer rainfall and strong commodity prices have boosted optimism about farm business conditions for the year ahead, reviving plummeting sentiment following one of the driest springs on record last year.

However the results are tempered by the ongoing recovery in regions ravaged by bushfires across the country and those areas where there is still a significant rainfall deficit and ongoing drought.

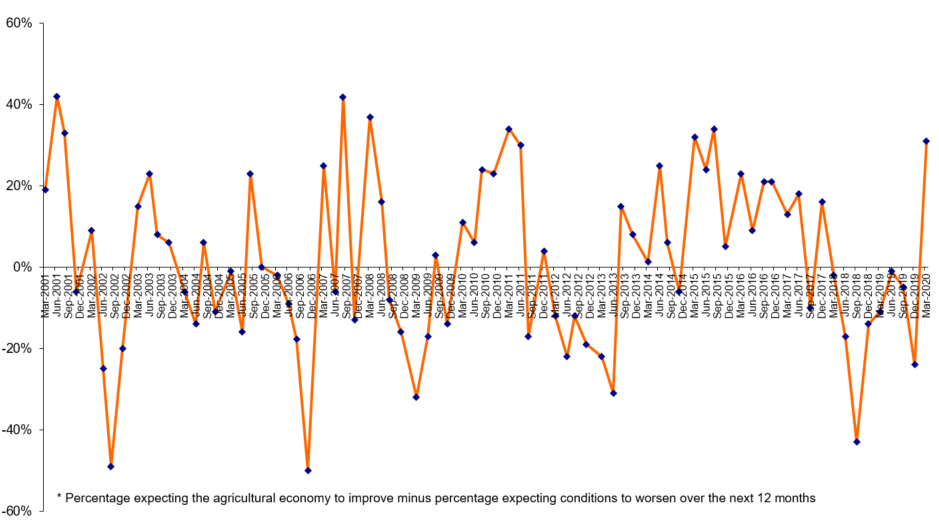

The first survey of the new decade reveals one of the biggest upswings in confidence in the survey’s 20-year history, with 46 per cent of farmers surveyed nationally expecting the agricultural economy to improve over the coming 12 months – up from 17 per cent in the December survey last year.

Farmers were also positive about an increase in their own income, with 38 per cent of those surveyed nationally expecting gross farm incomes to increase over the next 12 months, compared with 23 per cent at the end of last year.

Rabobank Australia CEO Peter Knoblanche said the past few weeks had delivered a great start for Australian farmers for the 2020 season, with widespread rainfall following years of drought and the recent shocking fire season.

He said strong commodity prices were now aligning with improved seasonal conditions, helping many farmers recover from long-running drought and move towards increased production again this year.

“With the fundamentals of demand and commodity pricing still firmly in Australian agriculture’s favour, many farmers are in a good position at the start of this year to take advantage of the improving season,” Mr Knoblanche said. “These factors will help farmers break free from the shackles of drought and hopefully move into a more favourable production cycle, but further rain throughout the year will be crucial.”

Mr Knoblanche said further rainfall received in early autumn, after the survey had been in the field, across large parts of the eastern states would likely have boosted rural confidence even further. However, he noted, uncertainty about the impacts of the developing COVID-19 virus epidemic on agriculture would be hanging over the sector.

States

Sentiment rose significantly in all states on the back of meaningful rain, with positive swings most notably in NSW and Queensland where long-running drought had subdued confidence for several years.

Following seven years of drought across parts of Queensland, the state recorded the most dramatic turnaround in sentiment in the survey’s history with 57 per cent of Queensland producers expecting conditions to improve in the coming year, up from just 19 per cent in late 2019. Seasonal conditions were the driving factor for almost three-quarters of Queensland respondents.

In NSW, 48 per cent of respondents said they expect the agricultural economy to perform better over the coming year – another big swing when compared to the 13 per cent of farmers with that view last quarter.

In Tasmania, sentiment is also solid with 40 per cent of farmers expecting business conditions to improve, just short of the 44 per cent of farmers who hold that view in South Australia – the highest confidence level in that state since early 2011 due also to a timely reprieve from a summer marred by bushfires and drought.

In Victoria, 41 per cent of farmers are confident about the year ahead while 37 per cent expect conditions to remain the same.

Whilst rainfall tallies haven’t been as significant for Western Australian farmers, they have still been enjoying a strong increase in sentiment regardless. One third of WA farmers were expecting conditions to improve while the percentage of farmers expecting conditions to worsen was just 12 per cent, down from last quarter’s 35 per cent reading.

Sectors

By sector, the positive sentiment is strongest among the nation’s beef producers, with more than half expecting the economy to improve in the coming year, followed by 53 per cent of sugar cane producers and 45 per cent of mixed livestock (sheep and cattle) producers.

Buoyed by good rain and dramatically improved winter cropping prospects, 43 per cent of grain growers are positive about conditions improving this year.

Water access concerns could be tempering some of the result for the dairy sector, with 37 per cent of dairy producers expecting an improvement in the ag economy this year – despite current all-time high prices for milk solids.

Well short of the confidence found in other sectors, only 27 per cent of cotton producers expect an improvement this year in the rural economy.

Farm business performance and investment

Nationally 38 per cent of farmers expect their gross farm income to increase, compared with 23 per cent at the end of last year. A further 39 per cent expect their incomes to stay the same (up slightly from 34 per cent) while 20 per cent expect a decrease in their incomes this year.

Over the next 12 months, one quarter of farmers surveyed said they expect to increase the total investment in their farm business over the next 12 months, up from 17 per cent, while 65 per cent said they would maintain investment at current levels (was 62 per cent).

“It is heartening to see how confident so many farmers are following on from, in many regions, several years of drought,” Mr Knoblanche said.

“It is also pleasing to note that many farmers have been encouraged by strong commodity prices to reinvest in their farm businesses by modernising farm infrastructure and implementing some drought preparedness measures.”

Climate change

This quarter, for the first time, farmers were also asked their views about climate change and its expected impact on their farming enterprises.

The survey found 67 per cent of those surveyed expect climate changes to have an impact on their business over the coming decade, with 20 per cent rating that effect as “major”.

Approximately 60 per cent indicated they were taking steps to minimise the impact of climate change, with managing water usage and irrigation – along with reducing stock for livestock producers – identified as the main actions.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in June 2020.

Rabobank Australia & New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank’s Rural Confidence Survey, please contact:

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Georgina Poole

Media Relations Manager

Rabobank Australia & New Zealand

Phone: 0418 216 103

Email: georgina.poole@rabobank.com