• National farmer confidence has continued to slide as producers express growing concern about the impact of COVID-19 and associated market downturns • Continued drought-breaking rain across many regions and a forecast bumper Australian grains harvest is however helping stabilise sentiment • Good seasonal conditions and low interest rates found to be still encouraging farmer investment and expansion |

Good winter rainfall across much of the country – signalling a turnaround from drought for many regions – hasn’t been enough to arrest a slide in Australian rural confidence as the sector grapples with concerns about COVID-19, overseas trade and markets and commodity prices.

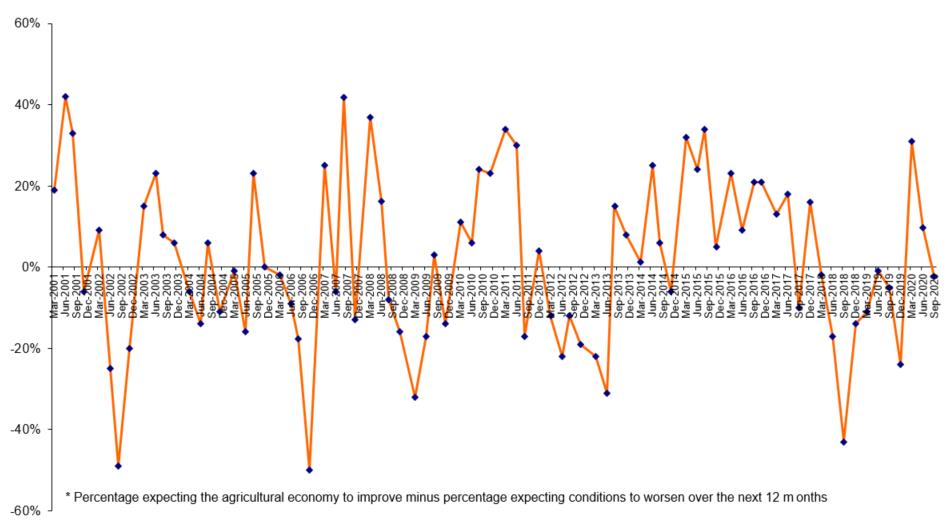

The latest Rabobank Rural Confidence Survey results, released today, reveal the nation’s farmer confidence has continued a downward trend, after beginning the year at close to a record five-year high.

All states, except Queensland and Tasmania, recorded some decline in sentiment, with the impacts of COVID-19 on agricultural markets increasingly weighing on the sector.

But the continued turnaround in seasonal conditions in many regions and the prospect of a bumper winter grain harvest are helping stabilise confidence levels.

The latest survey, completed last month, found 24 per cent of farmers surveyed nationally expect conditions in the agricultural economy to improve over the coming year, compared with 33 per cent with that outlook in the previous quarter. The number of farmers, however, with a pessimistic outlook on the year ahead stood at 27 per cent (from 23 per cent last quarter). A total of 44 per cent expect business conditions to remain relatively unchanged.

Beef, grain, cotton and dairy farmers are the most optimistic about the year ahead, but not all for the same reasons.

While price uncertainty is concerning grain and cotton farmers, the return to more normal production levels following drought and good harvest forecasts is supporting confidence in those sectors.

Strong commodity prices for beef and farmgate milk prices for dairy – and forecasts of a really positive spring season are bolstering sentiment.

Farm sentiment has, however, deteriorated further among sheep producers, nearly all due to market uncertainty.

Overall, farmers with a pessimistic outlook on the coming 12 months cited falling commodity prices, concern about overseas trade and markets and COVID-19 as the three main reasons for their negative view.

The mounting impact of the coronavirus pandemic on Australian farmer sentiment was evident over the past three surveys – nominated as factor of concern by six per cent of those expecting the agricultural economy to worsen in quarter one, by 26 per cent in quarter two and 37 per cent this survey.

Rabobank Australia CEO Peter Knoblanche said continued good rain throughout the winter months has been a boon for long-awaited good winter crops, particularly on the east coast, and the prospect of a big harvest right across the nation will inject some much needed cashflow back into farming businesses and regional communities after successive years of drought.

“Farmers are still keeping an optimistic outlook because in many of those areas which had been so severely drought affected, this is the harvest, and this is the big spring, they’ve been waiting for,” he said.

“For many farmers, this spring will be the season that allows them to consolidate their business position and start to ‘catch up’ after years of drought. The crops are looking good and livestock numbers are rebuilding. So that is all positive news for farmers on the home front.

“But concerns about the impact of COVID on trade, on consumer sentiment and what that means for markets is definitely worrying many.

“Wool and sheep producers, cotton and grape growers, and those industries like beef and grain which have been caught up in recent trade disputes with China, are concerned about market instability and what it could mean for their own incomes over the coming year. While in some sectors – such as wool, grain and horticulture – producers are also feeling the strain of border closures limiting access to seasonal labour.”

States

Farm confidence was shown to have declined in all states, except Queensland and Tasmania which went against the national trend.

And for New South Wales – while sentiment was back on the previous quarter – the state still recorded the highest rural confidence levels in the nation, with sentiment continuing to trend at its highest level since the 2016/2017 season. This was despite growing concerns about commodity pricing and market instability.

Cropping prospects in particular have boosted optimism in the state, Mr Knoblanche said, spurred on by regular and well-timed rain which saw the largest planting of winter crop hectares in four years and are supportive of excellent yield potential.

“New South Wales beef producers also expressed a very positive sentiment, driven by record prices and continuing demand. But the impact of COVID-19 on agricultural trade and markets is concerning a growing number of the state’s farmers,” he said.

While Victorian farmers were upbeat about the current season and spring ahead, the fallout of the coronavirus pandemic was also weighing more heavily on producers than it had in the previous quarter.

And, Mr Knoblanche noted, the fallout from the second Victorian lockdown and the restrictions on livestock processing had only just been surfacing at the time the survey was undertaken. “So while this factor may have influenced some responses, it would not have been fully reflected in this quarter’s results,” he said.

The survey showed only 16 per cent of Victorian farmers were expecting prospects to improve in the coming year, compared with 26 per cent who held that view in June. And one third of the state’s farmers were expecting conditions in the agricultural economy to worsen.

South Australian farm sentiment had continued its recent steady decline, with the state’s producers reporting heightened concerns about overseas markets and commodity prices.

Mr Knoblanche said worries about drought and COVID-19 were also shown to be dampening South Australian farmer sentiment, although to a lesser extent.

The percentage of the state’s farmers expecting business conditions to worsen now sits at 42 per cent – up from 19 per cent last quarter – and just 11 per cent expect an improvement.

While the survey did not reveal a dramatic drop in sentiment among Western Australian farmers, the state’s rural confidence is now at its lowest level since late 2019, mainly due to market uncertainty.

A dry winter had also been negatively impacting sentiment across WA, however, Mr Knoblanche said, since the survey was conducted, the state had recorded “widespread, meaningful rain which should go a long way to boosting farmers’ spirits”.

For Queensland, however, the survey revealed confidence was slowly returning after a mid-year fall in sentiment. This was largely driven by solid sentiment in the state’s beef sector.

Commodity prices, particularly for beef, and seasonal conditions were both cited as cause for optimism by the state’s farmers, but conversely, commodity prices were also a concern for those with a pessimistic outlook in the sugar and grains sector.

Tasmanian farm confidence had edged higher following good winter rain, despite concerns about instability in international markets. Dairy farmers were shown to be the state’s most optimistic producers, with 44 per cent of those surveyed expecting conditions to improve over the next year. And the survey found Tasmania reporting the highest reading of on-farm business viability across the nation.

Sectors

Across Australia, confidence was found to have trended down in the grain, beef and sheep sectors in the past quarter, while dairy, sugar and cotton sentiment had recorded some improvement.

Beef was the most optimistic sector, albeit down slightly on last quarter, Mr Knoblanche said. A total of 30 per cent of beef producers surveyed were anticipating improved business conditions in the next 12 months (down from 35 per cent in the previous survey).

Confidence was also high among cotton growers. Irrigation and production prospects had significantly improved in Queensland and northern NSW, Mr Knoblanche said, however cotton prices have been affected by current market instability which was weighing on sentiment somewhat.

Grain grower sentiment was found to be more subdued this quarter, with concerns regarding commodity prices and international markets and economies impacting outlook.

“That said, with the nation set up for what looks to be a bumper harvest this year, many of the nation’s grain producers, especially on the east coast, are in a much better position than they have been in recent years,” Mr Knoblanche said.

For dairy, strong farmgate milk prices, combined with a major turnaround in seasonal conditions in many regions, was supporting confidence among producers.

However, for the sheep sector, the ongoing fall in wool prices and looming uncertainty in the local lamb market continued to drive down sentiment this quarter – just 10 per cent of sheep producers expect business conditions to improve compared with 23 per cent with that view last quarter, with 38 per cent expecting conditions to worsen in the year ahead.

While confidence improved markedly in the sugar sector, the survey found there was still a greater percentage of respondents expecting conditions to worsen rather than improve.

Mr Knoblanche said a flatter price was driving sentiment, however the outlook for prices had since improved, with global prices breaking though the US13 cents per pound barrier in recent weeks – the first time since March.

Farm business performance and investment

Nationally, the number of farmers looking forward to improved incomes in the coming year had slightly declined.

The survey found 31 per cent of Australian farmers were anticipating higher gross farm incomes in the coming 12 months (down from 33 per cent with that view in the middle of the year). A similar proportion were also expecting lower farm incomes – at 30 per cent (relatively unchanged from the 29 per cent in June). A total of 39 per cent believed their incomes would stay the same.

NSW farmers were the most optimistic about their prospects, with 46 per cent expecting improved incomes in the next year on the back of the return to more favourable seasonal conditions.

With irrigation storages filling once again, cotton farmers were found to be the most optimistic sector in relation to incomes with 51 per cent nationally expecting an upturn.

In terms of on-farm investment, the number of producers intending to increase investment in their farm business over the next 12 months remained stable this quarter, at 25 per cent. But in NSW, this figure was higher – with 35 per cent intending to up investment (compared with 31 per cent last survey).

By sector, cotton growers had a strong investment appetite – with 46 per cent saying they will be increasing investment in their farm business in the year ahead.

On-farm improvements and drought recovery measures were the focus of much of this planned additional spending. Of those farmers planning to increase investment nationally, 62 per cent indicated it would be directed to improvements such as fences, sheds and silos, while 52 per cent have earmarked spending on pasture improvements, fodder, crops and fertiliser.

Increasing livestock numbers was also a priority for 45 per cent of those farmers planning to invest more this year, while the number intending to buy additional property remained unchanged at 25 per cent.

Mr Knoblanche said one of the stand-out trends in the Australian farm sector had been the continuing strength seen in the property market – a sign, he said, of underlying confidence in Australian agriculture beyond any present uncertainty.

“It’s a sign of the confidence in agriculture as an industry and is being helped by very low interest rates, good seasons and in most sectors, good income prospects,” he said.

“While the survey reveals farmers are growing more concerned about the impact of COVID-19 on the agricultural sector, intensions to grow their holdings and keep investing in their farm business are still very strong which is very encouraging.”

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in December 2020.

Rabobank Australia & New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

To arrange an interview or for more information on Rabobank’s Rural Confidence Survey, please contact:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Georgina Poole

Acting Media Relations Manager

Rabobank Australia & New Zealand

Phone: 0418 216 103

Email: georgina.poole@rabobank.com