Results at a glance:

- Sentiment among Australian farmers has dropped to its lowest level in more than four years in the latest quarter, after staging a rally at the end of last year.

- Easing commodity prices, rising interest rates and concerns about a return of drought conditions are the main factors weighing on farmer sentiment.

- Though input costs are now factoring as less of a concern.

- While farmer confidence declined on a national basis, WA and Tasmania bucked the trend as the only states to report a lift in sentiment.

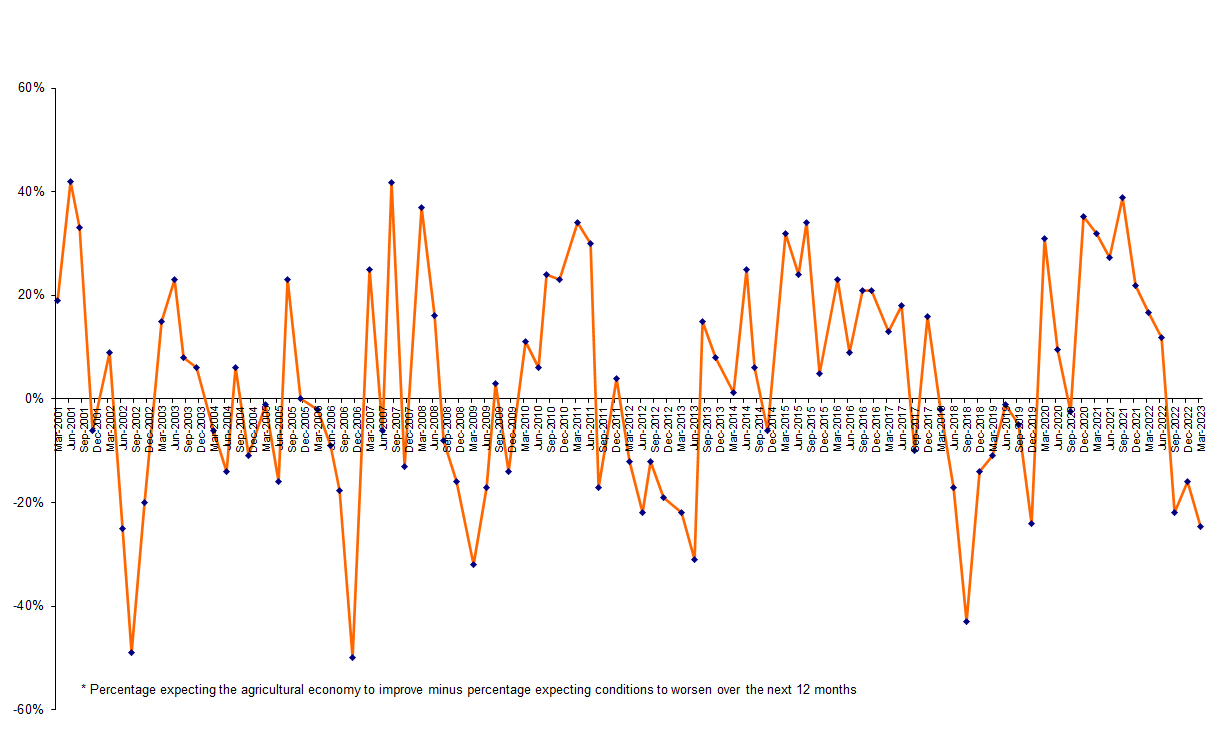

Australian farmers continue to ride the rollercoaster of seasons, commodity prices and economic factors, with rural sentiment at the start of 2023 dipping to its lowest level reported since late 2018.

The latest quarterly Rabobank Rural Confidence Survey, released today, found after rallying late last year, sentiment in the rural sector had fallen again this quarter as farmers continue to navigate a range of economic and financial uncertainties.

Western Australia and Tasmania, however, bucked the national trend, with producers in those states looking to the year ahead with increasing optimism.

The latest Rabobank survey, completed last month, found, nationally, the number of farmers expecting the agricultural economy to improve over the coming 12 months dipped to 11 per cent in the first quarter of 2023, compared with 15 per cent in December 2022.

Although just over half of Australian farmers continue to expect business conditions to stay the same (51 per cent, marginally up on 50 per cent), more are anticipating conditions to worsen (36 per cent, up from 31 per cent).

The main factor driving those with negative outlook is falling commodity prices, a worry for 68 per cent of those expecting conditions to worsen, a significant increase on 21 per cent previously, while rising interest rates were also an increasing concern (20 per cent, up from 11 per cent).

While not currently ranked as a major driver of negative outlook, there were also signs emerging of a growing concern about a return to dry conditions.

There was some relief though around the high cost of farm inputs – such as fuel, fertiliser and energy – but this remains a concern for 35 per cent of farmers expecting conditions to worsen over the next 12 months (down from 49 per cent last quarter).

Commodity prices were also, though, still cause for optimism among those farmers with a positive view on the year ahead.

Farmers who expect business conditions to improve were buoyed by commodity prices which are still strong – particularly for dairy, cane and beef producers – with 55 per cent listing this as a reason for their positive outlook, a similar level to the previous quarter (56 per cent).

There was increased confidence in overseas markets/economies contributing to good economic conditions – nominated by 26 per cent as cause for their positive outlook (up from 18 per cent).

Rabobank Australia CEO Peter Knoblanche said the latest survey reflects the combination of commodity prices, global economic challenges and high production costs facing farm businesses.

“Despite having their resilience tested throughout 2022, most Australian farmers ended last year on a high, buoyed by seasonal conditions and high commodity prices which saw our industry break farm production value records for the third year in a row,” he said.

“However, as we see the heat come off many commodities – albeit down from significant highs – farmers recognise conditions will start to return to more ‘normal’ levels.

“This survey captures their realistic expectations that commodity prices will likely not return to the highs this year that we saw in the previous 12 months.

“Although there’s relief with some input prices easing, the anticipation of further interest rates hikes will continue to place pressure on farm budgets.”

Underpinning these economic drivers is the emergence of fresh seasonal concerns, as farmers move away from the wet conditions which benefited many in 2022.

This survey, 13 per cent of farmers with a negative outlook reported being concerned about drought, up from just two per cent with that concern in the previous quarter. Likewise, concern around too much rain fell from 32 per cent to just six per cent.

And for those farmers with a positive outlook, 38 per cent attributed this to good seasonal conditions in the latest survey, down from 57 per cent at the end of last year.

“The, at times, excessive rain in 2022 did set up our nation’s grain farmers for record harvests and maintained beneficial feed base conditions for livestock businesses through summer, but again, we see the realistic expectations that 2023 won’t present the same conditions,” Mr Knoblanche said.

Q1 2023 RABOBANK RURAL CONFIDENCE SURVEY BREAKDOWN

States

Nationally, Western Australia and Tasmania were the only states to record an uptick in confidence for the year ahead.

Although rising interest rates, hand-in-hand with falling commodity prices, were still on WA farmers’ radars, they were buoyed by their second consecutive record-breaking winter grain crop.

Likewise, positive seasonal conditions through summer also boosted Tasmanian farmer confidence in the year ahead despite the economic factors at play.

However, despite a record harvest for many though, South Australian farmers started 2023 with lowered confidence, eroded by falling commodity prices and rising interest rates.

Victorian and NSW rural sector confidence also dipped, driven down by harvest delays in the aftermath of last year’s excessive rain, and – once again – compounded by easing commodity prices and interest rates.

It was the same story in Queensland, where only one in 10 producers expect agribusiness conditions to improve – dry seasonal conditions also played a factor in this state’s negative outlook.

Commodities

Sentiment also varied across the different commodity sectors. While beef and dairy had the most pessimistic outlook, other sectors were more optimistic.

The biggest fall in confidence was recorded in the beef sector, where only 10 per cent of producers expect the agricultural economy to improve – falling from 17 per cent last quarter. Fewer expect business conditions to stay the same (48 per cent, down from 57 per cent) and 39 per cent anticipate conditions to worsen, a jump from 22 per cent in the previous quarter.

Mr Knoblanche said those beef producers who are anticipating improved conditions ahead are looking beyond domestic factors to the strength of overseas markets, with a third identifying this as a driver of their confidence.

Confidence also fell in the dairy industry.

The biggest shift in factors identified by dairy farmers who think the economy will worsen was around falling commodity prices – with 71 per cent now citing this, significantly up from 13 per cent last quarter.

Mr Knoblanche said since global dairy commodity prices had peaked in quarter 2, 2022, spot prices have fallen between 20 and 40 per cent, depending on the product.

“Australian farm gate milk prices are still at record levels across the country though. And while weaker commodity returns will flow across southern Australian pricing, there should be a firm landing zone, given the solid domestic market returns and competition for milk supply among the dairy processors,” he said.

“Many dairy farmers enter autumn with good feed reserves and the availability of irrigation water and supplementary feed (after a decent 2022/23 winter crop) – and dairy farmer margins remain positive – as preparation begins for the next season.”

Confidence remained stable in the grains and sheep sectors.

The number of grain growers who expect the agricultural economy to improve fell from 17 per cent to 14 per cent, but this was offset by the number expecting it to worsen falling from 38 per cent to 33 per cent. This saw a very slight edging up in net confidence in the grain sector.

For the grain growers who expect conditions to improve, their buoyant outlook was attributed to a good season (54 per cent) and lower input costs (17 per cent).

Grain growers who believe economic conditions will deteriorate flagged falling commodity prices as being more front of mind this quarter (59 per cent up from 16 per cent last survey), along with rising interest rates (27 per cent up from five per cent) and the re-emergence of drought (18 per cent up from zero).

Confidence in the sheep sector also remained broadly unchanged. As with other sectors, sheep producers who do think the economy could worsen again pointed to falling commodity prices (79 per cent up from 35 per cent last quarter) and rising interest rates (15 per cent up from six per cent last quarter).

Sugar cane was the only sector, outside grain, on a national level to report increased confidence, but this was from a low base with 13 per cent reporting an optimistic outlook (compared with 10 per cent last quarter), and 41 per cent expecting conditions to worsen (albeit down from 49 per cent).

Farm performance and investment

Nationally, more farmers expect lower farm incomes in the year ahead (36 per cent, compared with 25 per cent last survey) while fewer anticipate higher incomes (20 per cent, down from 29 per cent).

However, the sector remains robust with the number of farmers who describe themselves as easily viable/viable holding steady quarter on quarter.

“The combination of commodity prices, global economic challenges and high production costs compounded this quarter to contribute to a more unfavourable outlook from a gross farm income perspective,” Mr Knoblanche said.

“These key drivers also pulled together to dampen investment intention, with slightly more farmers planning to ease off on the level of investment in their business in the coming 12 months.”

“Australian farm gate milk prices are still at record levels across the country though. And while weaker commodity returns will flow across southern Australian pricing, there should be a firm landing zone, given the solid domestic market returns and competition for milk supply among the dairy processors,” he said.

“Many dairy farmers enter autumn with good feed reserves and the availability of irrigation water and supplementary feed (after a decent 2022/23 winter crop) – and dairy farmer margins remain positive – as preparation begins for the next season.”

Confidence remained stable in the grains and sheep sectors.

The number of grain growers who expect the agricultural economy to improve fell from 17 per cent to 14 per cent, but this was offset by the number expecting it to worsen falling from 38 per cent to 33 per cent. This saw a very slight edging up in net confidence in the grain sector.

For the grain growers who expect conditions to improve, their buoyant outlook was attributed to a good season (54 per cent) and lower input costs (17 per cent).

Grain growers who believe economic conditions will deteriorate flagged falling commodity prices as being more front of mind this quarter (59 per cent up from 16 per cent last survey), along with rising interest rates (27 per cent up from five per cent) and the re-emergence of drought (18 per cent up from zero).

Confidence in the sheep sector also remained broadly unchanged. As with other sectors, sheep producers who do think the economy could worsen again pointed to falling commodity prices (79 per cent up from 35 per cent last quarter) and rising interest rates (15 per cent up from six per cent last quarter).

Sugar cane was the only sector, outside grain, on a national level to report increased confidence, but this was from a low base with 13 per cent reporting an optimistic outlook (compared with 10 per cent last quarter), and 41 per cent expecting conditions to worsen (albeit down from 49 per cent).

Farm performance and investment

Nationally, more farmers expect lower farm incomes in the year ahead (36 per cent, compared with 25 per cent last survey) while fewer anticipate higher incomes (20 per cent, down from 29 per cent).

However, the sector remains robust with the number of farmers who describe themselves as easily viable/viable holding steady quarter on quarter.

“The combination of commodity prices, global economic challenges and high production costs compounded this quarter to contribute to a more unfavourable outlook from a gross farm income perspective,” Mr Knoblanche said.

“These key drivers also pulled together to dampen investment intention, with slightly more farmers planning to ease off on the level of investment in their business in the coming 12 months.”

“Australian farm gate milk prices are still at record levels across the country though. And while weaker commodity returns will flow across southern Australian pricing, there should be a firm landing zone, given the solid domestic market returns and competition for milk supply among the dairy processors,” he said.

“Many dairy farmers enter autumn with good feed reserves and the availability of irrigation water and supplementary feed (after a decent 2022/23 winter crop) – and dairy farmer margins remain positive – as preparation begins for the next season.”

Confidence remained stable in the grains and sheep sectors.

The number of grain growers who expect the agricultural economy to improve fell from 17 per cent to 14 per cent, but this was offset by the number expecting it to worsen falling from 38 per cent to 33 per cent. This saw a very slight edging up in net confidence in the grain sector.

For the grain growers who expect conditions to improve, their buoyant outlook was attributed to a good season (54 per cent) and lower input costs (17 per cent).

Grain growers who believe economic conditions will deteriorate flagged falling commodity prices as being more front of mind this quarter (59 per cent up from 16 per cent last survey), along with rising interest rates (27 per cent up from five per cent) and the re-emergence of drought (18 per cent up from zero).

Confidence in the sheep sector also remained broadly unchanged. As with other sectors, sheep producers who do think the economy could worsen again pointed to falling commodity prices (79 per cent up from 35 per cent last quarter) and rising interest rates (15 per cent up from six per cent last quarter).

Sugar cane was the only sector, outside grain, on a national level to report increased confidence, but this was from a low base with 13 per cent reporting an optimistic outlook (compared with 10 per cent last quarter), and 41 per cent expecting conditions to worsen (albeit down from 49 per cent).

Farm performance and investment

Nationally, more farmers expect lower farm incomes in the year ahead (36 per cent, compared with 25 per cent last survey) while fewer anticipate higher incomes (20 per cent, down from 29 per cent).

However, the sector remains robust with the number of farmers who describe themselves as easily viable/viable holding steady quarter on quarter.

“The combination of commodity prices, global economic challenges and high production costs compounded this quarter to contribute to a more unfavourable outlook from a gross farm income perspective,” Mr Knoblanche said.

“These key drivers also pulled together to dampen investment intention, with slightly more farmers planning to ease off on the level of investment in their business in the coming 12 months.”

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the Rabobank Rural Confidence Survey has been conducted since 2000 by an independent research organisation. The next results are scheduled for release in June 2023.

Rabobank Australia & New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 93 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com