Results at a glance: • Farm sector confidence eases, but strong signals of long-term optimism across all sectors • Farmers report highest business viability in survey’s history • Commodity prices continue to underpin positive farm business sentiment • NSW and Queensland assessing impacts of major rainfall and flooding, which will impact income prospects |

Australian farmers are predicting the “magic combination” of high commodity prices, low interest rates and good seasonal conditions will continue in the year ahead – sustaining a continued high level of confidence across the sector.

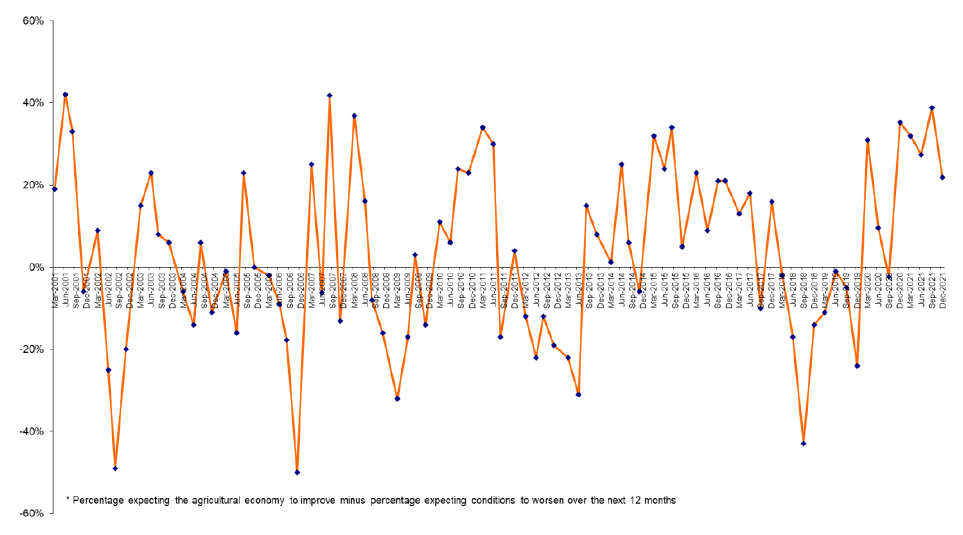

The Q4 Rabobank Rural Confidence Survey, released today, has shown Australian farm sector confidence held strong over the latest quarter, albeit easing from the near-record levels reported last survey.

The impact of recent excessive rainfall and flooding in southern Queensland and northern and central New South Wales’ grain-growing regions – which has devastated many crops on the point of harvest – has yet to be taken into account though, coming, for the main part, after the survey was in the field. This is expected to significantly alter previously-high income projections in the grain sector.

Growers in impacted regions have been counting the cost of significant downgrades or complete ruination of what was shaping up as one of the biggest winter harvest years on record.

Fortunately, production losses have not been as significant in the livestock sector, which continues to enjoy sustained high commodity prices and favourable grazing conditions, while many summer croppers and cotton producers look set to capitalise on surety of water supplies and full soil moisture profiles.

The survey – completed last month – showed while overall national farmer confidence had softened on last quarter, it remained at still strong levels, with 84 per cent of Australian farmers surveyed forecasting the agricultural economy will continue to perform at, or exceed, its currently-excellent levels in the year ahead.

The survey has also reported record high levels of business viability, with the Farm Viability Index – measuring farmers’ assessments of their own business viability – now sitting at the highest level in the survey’s history.

Rabobank Australia CEO Peter Knoblanche said strong demand for Australian commodities, good seasons and favourable business settings were supporting solid, long-term confidence, although this would likely be diminished among grain growers and other flood-affected producers heading into the end of the year.

“Overall, there is significant long-term positivity in Australia’s farm sector – we see it in the high levels of farm viability reported, in farmers’ strong investment plans, and in the optimism about the year ahead,” he said. “But while above-average rainfall has been a blessing in some sectors, it has caused significant heartbreak in others.

“The full extent of the damage to this year’s east coast winter grain harvest, in particular, is still being assessed, and it’s unclear yet just how much grain has been downgraded to feed quality, and how much will be a write-off. This is particularly heartbreaking for grain growers as they were very optimistic about this year’s crop – it had enormous potential in both yield and value.”

The latest survey found 35 per cent of farmers surveyed nationally were expecting conditions in the agricultural economy to improve over the year ahead, easing from 43 per cent with that view in the September quarter.

A further 49 per cent of respondents reported they were expecting farm business conditions to remain stable over the coming 12 months, while 13 per cent expect conditions will worsen – an increase on the four per cent of farmers with that view last quarter.

Rising commodity prices continue to be the primary driver of positive outlook across all sectors, with 77 per cent of farmers expecting conditions to improve citing commodity pricing as the key reason. Favourable seasonal conditions were still also a cause for optimism, but less so this quarter – cited by 58 per cent of those expecting improved conditions (down from 70 per cent last quarter).

Mr Knoblanche said Rabobank’s Rural Commodity Price Index (comprising local prices for 10 agricultural commodities) eclipsed its previous all-time high in November, with small drops in the price of sheepmeat, wool, and sorghum offset by increases for all other commodities, particularly canola, to set a new benchmark in the 12-year history of the index.

The ongoing rise in input costs – particularly fertiliser and farm chemicals – was growing as a concern, however, Mr Knoblanche said, and could be a significant challenge for the farm sector next year.

Rising input costs were the main issue nominated by farmers in the survey who were expecting conditions to deteriorate in the year ahead (cited by more than half). By comparison, four per cent attributed their pessimistic view to COVID-19 and four per cent to too much rain.

States

Before the recent rainfall deluge and subsequent flooding, Queensland and NSW producers had been the most confident about business conditions next year – 90 per cent and 88 per cent respectively forecasting conditions to continue to be good, or improve further, over the year ahead.

In Queensland, Mr Knoblanche said, recent rainfall was being viewed as having more positive than negative impacts by many producers and would be a boon for the state’s pastoral industry heading into summer.

Impacts from recent rainfall and flooding were mixed in NSW, with the most negative effects confined to croppers in the Central and North West regions, while farmers in the Riverina are eager for weather to warm up and crops to dry out for the southern harvest.

Farmer confidence in Western Australia retreated from the 10-year highs recorded last quarter, but remained at positive levels in the latest survey, with a record harvest forecast for the state.

Mr Knoblanche said rising input costs and the impacts of a frost event in spring appeared to have taken some of the edge off farmer confidence in the west. “But to a large degree it is probably a case of farmers there thinking things can’t get much better than they are right now,” he said.

Sentiment also declined, though remained at relatively strong levels, in South Australia, with the state’s producers missing out on crucial spring rainfall, and optimism about the year ahead waning among grain growers in particular.

As with the rest of the country, Tasmanian rural confidence also eased slightly, but was still tracking at very strong levels, with 90 per cent of the state’s farmers expecting a continuation or improvement in the current excellent business conditions (albeit down on the 100 per cent with that view over the previous two quarters).

Conditions for the state’s beef and dairy producers continue to be excellent, which is underpinning much of the positivity, however ongoing wet conditions are presenting some challenges.

Wet conditions have not significantly dented confidence among farmers in Victoria, although sentiment has eased during the latest quarter. Workforce shortages and rising input costs are shaping up as concerns heading into 2022.

Sectors

While seasonal conditions and returns are still excellent for the meat and dairy sectors, the survey revealed concerns about weather impacts were already mounting for grain growers leading into harvest of winter crops.

At the time of the survey, and before the impact of flooding and too much rain in the eastern states, grain sector confidence had already begun to retreat – this quarter 39 per cent of the nation’s grain growers expressed optimism about improved conditions (from 64 per cent last survey) while 26 per cent thought conditions would worsen (up from one per cent).

Mr Knoblanche said summer croppers in the eastern states have largely welcomed the spring deluge, and even flooding will provide a beneficial soak in some areas, however there are reports that some summer crops will need replanting after too much rain, especially in the Liverpool Plains of NSW and southern reaches of the Darling Downs and border region in Queensland.

Cotton sector confidence was again the stand-out this quarter, with 78 per cent of growers surveyed expecting business conditions to improve in the next 12 months (was 70 per cent in September), and analysts expect this to be the case for some time, given the now-healthy state of water storages and dams in cotton-growing regions.

Positive seasonal conditions continue to support young cattle prices with stunning strength continuing in Australia’s beef market translating to firm optimism among beef producers.

Sheepmeat producers have also had a solid year with strong returns, underpinning optimism and longer-term business plans.

Mr Knoblanche said limited livestock numbers combined with strong global demand for sheepmeat should help keep demand and prices high. Meanwhile, for wool growers, fine and superfine wool prices are holding at high levels on the back of improved demand and combined with excellent seasonal conditions.

While dairy sector confidence has eased, it is still very solid this quarter, and good seasonal conditions, water availability and demand are underpinning longer-term optimism about business conditions over the coming couple of years, fuelling ongoing investment within the sector. The survey found a combined 90 per cent of the country’s dairy producers optimistic the current conditions will either continue or improve over the year ahead.

Farm business performance and investment

In line with an overall easing in sentiment, Australian farmers have slightly revised down forecasts for the financial performance of their own businesses. The latest survey found 47 per cent of those surveyed expect their gross farm incomes to increase over the year ahead (was 51 per cent) while 40 per cent predict earnings to be the same.

Mr Knoblanche said assessments of the damage to the large areas of rain and flood- affected crop were still ongoing and will significantly impact returns for those affected within the grains sector.

More generally, however, the survey showed farmers were continuing to look for expansion and investment opportunities. On-farm projects and infrastructure which boost productivity, efficiency and alleviate workforce pressures were a particular focus.

The survey found close to 40 per cent of farmers surveyed expect to increase investment in their farm business next year. For those intending to increase spending, 71 per cent is earmarked for on-farm infrastructure and 53 per cent for new plant and machinery.

One quarter of those looking to increase business investment plan to do so through property purchase and expansion.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in March 2022

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 94 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com