Results at a glance:

- High commodity prices sustain confidence in Australian farm sector, despite growing concerns about higher input costs

- Impacts of devastating flooding on farm incomes and production in Queensland and NSW still being assessed

- Plans to invest in farm business continue to hit high levels

Australia’s farmers are forecasting a third straight year of strong commodity prices and intending to spend up big this year, but are wary of the rising cost of key inputs, according to the latest Rabobank Rural Confidence Survey.

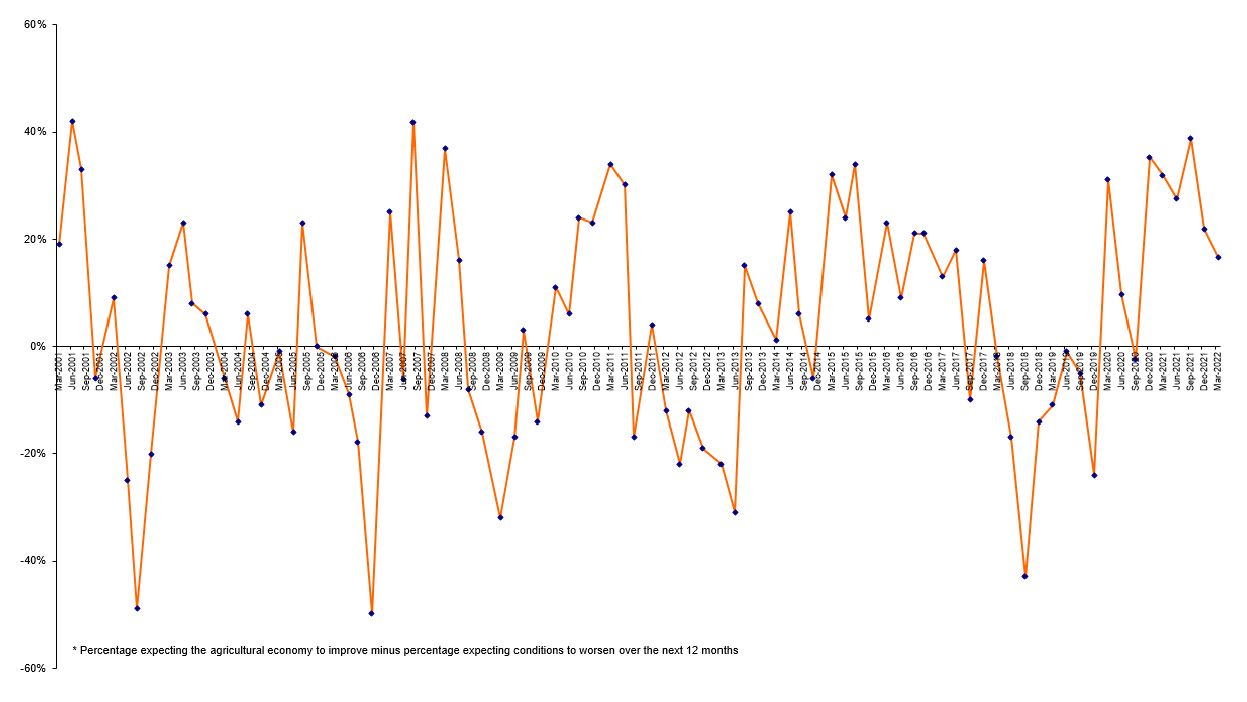

Results from the first quarter survey, released today, reveal high prices across key agricultural sectors have been sustaining rural confidence, with farm sector business investment plans continuing to sit at high levels, despite sentiment easing slightly since late last year.

However, the long-term impact of the recent flooding disaster along Australia’s east coast – particularly in southern Queensland and the New South Wales Northern Rivers – was not factored into these results, with the survey completed prior to the excessive rainfall events which, it is expected, will significantly change production and income projections in several key farming regions.

The survey, completed last month, found 31 per cent of farmers expect agribusiness conditions to improve on last year – down slightly on the 35 per cent with that view last quarter.

Just over half expect a continuation of last year’s very good business conditions, while the number expecting a deterioration was 14 per cent (compared with 13 per cent in the previous quarter).

Livestock producers and canegrowers were found to be the most optimistic sectors.

Rabobank Australia CEO Peter Knoblanche said consistently-high commodity prices over the past three years had put the nation’s farmers in a very strong position, even in the face of some immensely-challenging seasonal conditions and natural disasters in some regions.

“Australian farm businesses are overwhelmingly optimistic about the long-term fundamentals underpinning agriculture,” he said.

“Low interest rates and continued strength in our markets are helping farmers create opportunities for growth and expansion which is driving greater productivity across the sector.”

Mr Knoblanche said the regions in southern Queensland northern NSW affected by the recent flooding disaster had been some of the most optimistic in the recent survey, and the full extent of the damage to agriculture was still unclear.

“The flooding and extreme rainfall have had major impacts on many agricultural producers in these regions,” he said. “In particular, dairy farmers have suffered herd losses and damage to infrastructure. There have also been livestock losses among cattle farmers as well as crop damage in sectors such as horticulture, sugar cane and soy beans.

“In addition, agricultural freight and logistics networks were significantly affected and may remain impacted for some months. The full extent of the damage is still not yet known and, for many in these regions, it may take a number of seasons to recover.”

For the country more broadly, the latest survey revealed commodity prices ‘as king’, with 83 per cent of those expecting improved prospects in the coming year citing prices as the driving factor. Seasonal conditions were also a major contributor to the positive sentiment.

Almost two-thirds of farmers predicting a deterioration in business conditions attributed that view to rising input costs.

Mr Knoblanche said Rabobank analysts were closely monitoring the impact of the Russia-Ukraine conflict on markets and supply of key agricultural inputs – particularly for urea and, to a lesser extent, potash – with any rise in input prices likely to weigh further on farmer sentiment.

“The worst impacts of the geopolitical situation on food security – in terms of availability and food price inflation – are sadly most likely to affect those in the poorest nations of the world,” he said. “Based on the current production outlook, it is pleasing that Australia should be in a good position to contribute well in providing exports to help with global supply.”

States

Tasmania and Queensland farmers reported the highest confidence levels in the country – marginally ahead of New South Wales – and were the only states to record a slight improvement in sentiment in the quarter.

High livestock prices were shown to be behind Tasmanian producers recording strong levels of optimism, with 40 per cent expecting agribusiness conditions to improve over the year ahead, while 51 per cent expect the currently good business settings to continue.

Before the unfolding flooding disaster, Queensland and NSW farmers also exhibited very high levels of optimism (39 per cent and 38 per cent respectively are expecting improved business conditions in the coming year), with above-average rainfall throughout summer sustaining sub-soil moisture, ensuring excellent pasture growth and solid prospects for winter-crop planting.

Bushfires and dry conditions have tempered optimism in Western Australia over the summer, however most farmers are expecting farm business conditions to stay the same or improve. The state’s farmers also had the strongest appetite in the country to purchase additional land.

Farmer confidence levels had also stabilised in South Australia, after falling in the previous survey, with just over half of producers now expecting conditions to remain the same over the coming year. Good summer rainfall over the state’s pastoral areas had buoyed beef producers, with water also making its way into the Lake Eyre system. The state also enjoyed an above-average harvest and good crop yields last year.

Sentiment remains at solid levels among Victorian producers, with dairy, beef and sheep producers all optimistic thanks to good feed reserves, excellent water allocations and continuing high prices.

Sectors

Input costs were shown to be the main concern for grain growers this quarter, with the survey revealing more grain farmers expecting conditions to worsen than improve this quarter. The last time grain sector sentiment was in negative territory was December 2019.

Of the grain farmers reporting a negative outlook, more than three quarters cited rising input costs, while almost half were worried about the prospect of falling commodity prices.

While 44 per cent of grain growers expect their farm incomes to remain the same in the next 12 months, 28 per cent expect an income decline and 26 per cent expect an increase.

Beef producers continue to enjoy the magic combination of wet seasons and high prices, with 34 per cent tipping conditions to improve further over the year ahead, and almost half of cattle farmers surveyed expecting their gross farm incomes to increase on last year’s returns.

Strong commodity prices underpin solid sentiment among sheep producers with almost one third surveyed expecting conditions to keep improving over the next 12 months.

Although dropping slightly since January, lamb prices had been setting new records for most of late 2021, while fine wool prices have carved a way through some COVID uncertainty to reach some solid levels again.

Investment intentions in the sheep sector have reached one of the highest levels in more than a decade.

Most dairy producers surveyed expected a continuation of current good seasonal and market conditions, with an abundance of feed and water security helping to lock in high levels of positive sentiment in the sector.

Prior to the extreme weather events in Queensland in the past fortnight, sugar producers were the most optimistic of all sectors, primarily due to positive prices. The survey found 55 per cent of canegrowers were expecting business conditions to improve at the start of this year.

Farm business performance and investment

Australian farmers were shown to have (slightly) revised down expectations about their gross farm incomes over the coming year, although income expectations remained at healthy levels. The survey found 41 per cent of farmers forecast their farm incomes to increase this year, while 42 per cent expect incomes to stay the same and 15 per cent expect a decrease.

The survey found 40 per cent of the country’s farmers intend to increase investment in their farm businesses over the coming year.

On-farm infrastructure spending, followed by investment in new machinery and equipment, remain priorities for those surveyed, while the survey also noted a growing level of investment being directed towards new technology this year.

Mr Knoblanche said farmers were well placed to maximise opportunities which boost their businesses and productivity which, in turn, should help build resilience within the sector.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the survey has been conducted by an independent research organisation interviewing farmers throughout the country each quarter since 2000. The next results are scheduled for release in June 2022.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com