Results at a glance:

• National rural confidence edges slightly up with fewer farmers reporting negative expectations of the year ahead

• Positive seasonal conditions a key driver among those with optimistic outlook

• Concern about the impact of too much rain though also weighing on others in the sector

Australia’s farmers are heading towards the end of 2022 with signs of growing optimism, following a year where challenges around high input costs, excessive rainfall and biosecurity concerns had taken the edge off otherwise generally very positive seasonal conditions and commodity prices.

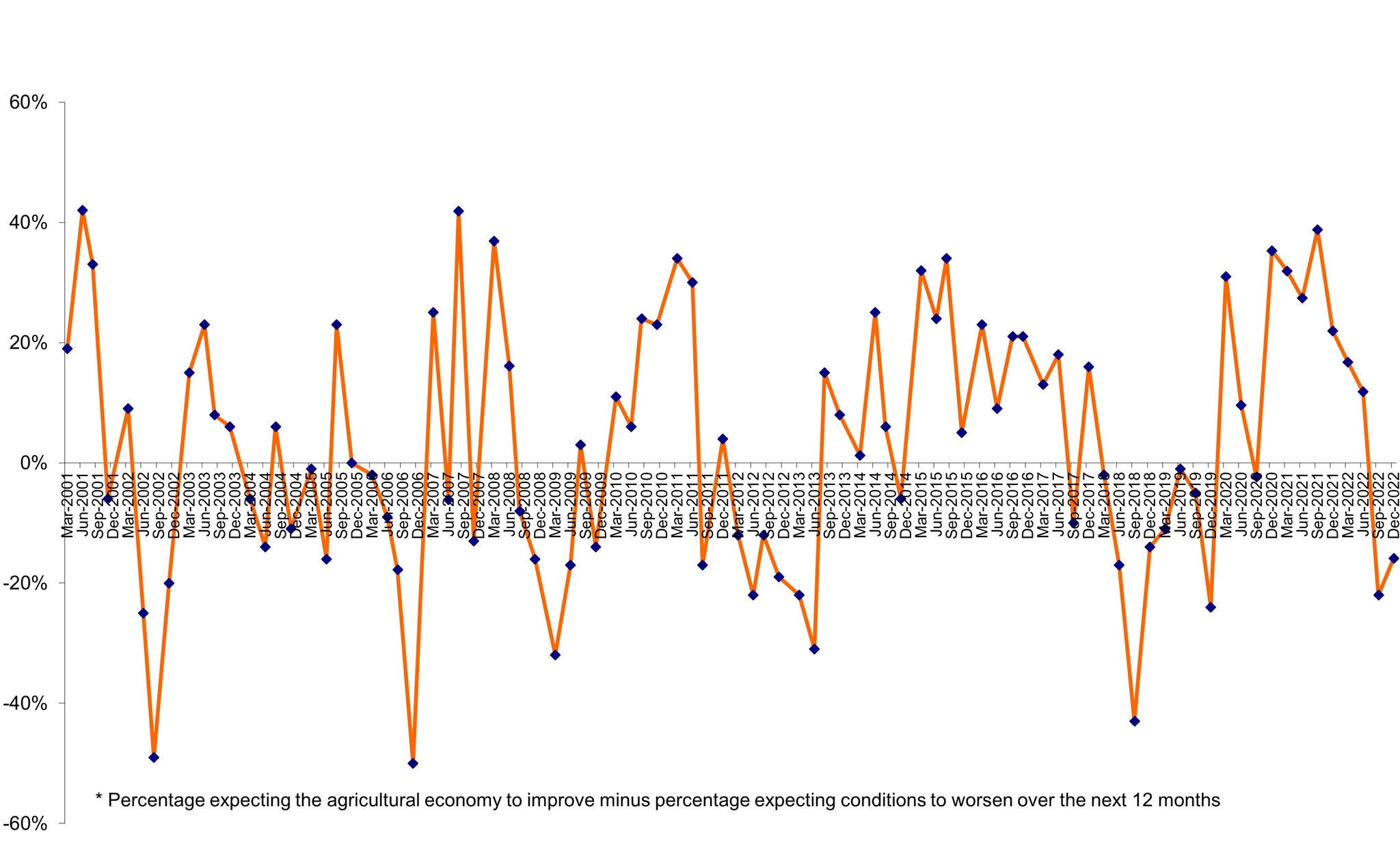

The latest quarterly Rabobank Rural Confidence Survey, released today, found sentiment was edging back up after four consecutive quarters of decline, with fewer farmers now expecting agricultural business conditions to worsen on the back of a wet spring and easing concerns about commodity prices and biosecurity.

The survey showed more farmers are now buoyed by expectations of a good season with the highest level of seasonally-driven optimism seen in 2022 – nominated by 57 per cent of farmers with expectations of an improved year ahead, up from 35 per cent in the previous quarter.

However, this was tempered by those who are managing the fallout of too much of a good thing, with 32 per cent of farmers who expect the agricultural economy to worsen citing too much rain as a key reason, driven by a third La Nina which delivered flooding, damaging storms and record rainfall.

Rabobank Australia CEO Peter Knoblanche said the latest survey reflects an enduring confidence in agriculture, despite the mixed bag of challenges Australian farmers continue to face.

“Domestic and global demand for our rural commodities underpins productivity and profitability across sectors, and, with three years of improved seasonal conditions now under our belts, farmers have the confidence to make long-term investments into their businesses,” Mr Knoblanche said.

“That said, we’re still seeing the seasonal resilience of farming businesses being tested – many have weathered droughts and bushfires to then face extreme wet conditions, which create challenges of a different nature. This has reined in the earlier seasonal optimism for some, while for others La Nina will deliver a record grain harvest and set up their feed base and soil moisture reserves for the new year.

“It certainly hasn’t been a one-size-fits-all this year, which is driving the varied responses of farmers across states and sectors.”

The survey, completed last month, found 15 per cent of farmers were expecting improved business conditions in the coming 12 months (compared with 14 per cent last quarter), while 50 per cent had a stable outlook (up from 43 per cent). A total of 31 per cent expected operating conditions to deteriorate (down on the 36 per cent with that view previously).

In addition to optimism about good seasonal conditions, positive sentiment is being primarily driven by commodity prices – though this was down on last quarter, nominated by 56 per cent of those expecting business conditions to improve (compared with 73 per cent in the previous survey).

The high cost of farm inputs – such as fuel, fertiliser and energy – remains a concern for nearly half of farmers (49 per cent) who expect the agricultural economy to worsen, however this has dropped from the 62 per cent who had that concern in the middle of the year.

Concern around government interventions and policies appears to be rising, with 17 per cent of farmers who expect the economy to worsen noting this as a factor – up from 11 per cent previously.

Farmers though are less worried about softening markets/commodity prices, with 21 per cent citing this as cause for their negative outlook compared with 40 per cent in the previous survey.

Concerns about biosecurity also plummeted, with just one per cent of those who expect the agricultural economy to worsen noting the threat of foot and mouth disease (FMD) as a concern – down from 39 per cent in the previous results.

Interestingly, Mr Knoblanche, said inflation was not found to be significantly weighing on rural confidence, with only three per cent of farmers listing it as cause for their pessimistic outlook. Interest rates were reported as a concern by 11 per cent of farmers expecting deteriorating business conditions in the year ahead, down from 15 per cent with that concern in the previous survey, despite recent interest rate hikes.

States

The recent flooding and excessive rain in parts of New South Wales failed to dampen overall sentiment among farmers there, with confidence rallying in the latest quarter. More farmers were expecting business conditions to improve and almost half were expecting conditions to remain stable.

In Victoria however, the extended rainfall and significant flooding saw rural confidence plateau with fewer farmers anticipating business conditions would improve, but also fewer expecting them to deteriorate.

In Tasmania – where farmland was mostly saturated but not flooded – rural sentiment improved slightly, on the back of strong beef and dairy prices and seasonal conditions which, despite cropping delays, will generally set producers up for the year ahead.

In Queensland, where seasonal conditions were generally more positive than other parts of the eastern states, confidence has stabilised after a significant decline last quarter, with fewer producers pessimistic about prospects in the coming 12 months.

South Australian farmer confidence also edged higher, after a drop last quarter, with the state’s rural sentiment the highest in the country.

Confidence within Western Australia’s farming sector remains suppressed this quarter, with high farm input costs and the prospect of easing commodity prices the chief concerns.

Sectors

Of the sectors, confidence was found to have lifted significantly among the nation’s beef producers and was also up slightly in the sheep sector, while other commodities reported a decline in sentiment.

The seasonal mixed bag was reflected in the sentiment of grain growers across the nation, with confidence in the sector falling, despite Australia being on track to harvest a third consecutive bumper winter crop.

While the wet spring delivered excellent seasonal conditions for many regions, it also presented significant challenges for grain growers coming into the summer harvest period, Mr Knoblanche said.

“While growers in some parts of Western Australia and South Australia will reap record, or near-record, crops, the La Nina roulette means many growers in Victoria and NSW are coming to terms with the impact of flooding and excessive rain and some are still unable to even get out into their paddocks,” he said. “With low-lying paddocks under water for extended periods of time, these growers are facing yield, volume and quality downgrades as well as, for some, simply unharvestable crops.”

Rising input costs were the main driver for grain farmers expecting conditions to worsen this quarter and there was a significant shift in those worried about the impact from too much rain, spiking to 33 per cent, up from just three per cent in the previous quarter.

Mr Knoblanche said with the harvest workforce top of mind at this time of year, the shortage of labour – which wasn’t a concern at all in the previous quarter – had emerged as a worry for 14 per cent of grain growers who anticipate conditions to worsen.

The Australian red meat sector is ending the year on a high, he said, following market conditions which – while not quite at the record levels of 2021 – still delivered strong beef, sheep and lamb prices.

Confidence levels increased for sheep and beef producers this quarter, driven by seasonal conditions and commodity prices and a dramatic easing of biosecurity concerns.

In particular, the beef sector enjoyed a bounce in confidence, with 17 per cent of cattle producers expecting the agricultural economy to improve (up from 10 per cent last quarter) and only 22 per cent expecting it to worsen (down from 36 per cent).

Last quarter, more than half of all beef producers were concerned about FMD but none raised it as a concern in this latest survey.

Likewise, confidence among sheep producers also improved – although the shift wasn’t as significant as the beef sector.

Nearly half of sheep producers expect conditions to remain the same (49 per cent, up from 45 per cent), and fewer now expect conditions to worsen.

Mr Knoblanche said with many milk-producing regions in New South Wales and Victoria at the heart of recent flooding and excessive rain, it was not surprising the dairy industry presented a significant decline in confidence this quarter, with only 16 per cent of dairy farmers nationally expecting the agricultural economy to perform better in the year ahead (compared with 27 per cent last quarter) and 29 per cent expecting it to worsen (up from 19 per cent).

Half of dairy farmers who expect the agricultural economy to worsen cited too much rain as a cause – a spike from just 11 per cent in the previous survey.

Although fewer dairy farmers expect conditions to improve due to rising commodity prices, this is still very strong – 84 per cent, down from 98 per cent in the previous quarter.

Sugar cane growers were shown to be the least optimistic of all sectors, with just 10 per cent reflecting a positive sentiment and more expecting conditions to worsen (49 per cent).

Mr Knoblanche said this year’s crop was large with production up from last year, although wet weather had caused delays in the crush, and growers’ main concerns were about high input prices and excessive rainfall.

“Similarly, cotton sector confidence has also declined,” he said. “Cotton growers have largely enjoyed a couple of good years of business and seasonal conditions, however, the wet weather has created challenges in recent months and its likely there will be a reduced total area planted across New South Wales, compared with original expectations.”

Farm performance and investments

In line with the uptick in national farmer confidence levels, farmers were slightly more optimistic about their income expectations in the year ahead. A total of 29 per cent indicated they expected their incomes to rise, 45 per cent were expecting similar incomes to the previous year while 25 per cent anticipated a decrease.

Appetite to invest in farming operations had also increased in the latest quarter.

The number of farmers planning to increase spending on their farm businesses in the coming 12 months edged up to 27 per cent (from 25 per cent previously), while the number planning to reduce their spend had declined to nine per cent (from 13 percent). A total of 64 per cent indicated they would maintain the same level of investment in their farming operations.

For those farmers planning to increase spending in the year ahead, on-farm infrastructure – such as fences, silos and yards – topped the shopping list (planned by 79 per cent) ,while half have earmarked capital for new plant and machinery and 47 per cent are looking to grow livestock numbers (up from 37 per cent the previous quarter).

The appetite for purchasing land held fast, with 26 per cent of those farmers who were planning to up their investment saying they intended to fund property purchases to expand their farming operations (compared with 22 per cent in the previous quarter).

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the Rabobank Rural Confidence Survey has been conducted since 2000 by an independent research organisation. The next results are scheduled for release in March 2023.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com