Will Brazil’s 2023/24 crop alleviate supply constraints?

Despite weakening demand, the global supply/demand balance is on course for another deficit this season, albeit smaller than the past two years. All eyes are on the first forecasts for Brazil’s 2023/24 harvest as a measure of global supply. Some early indications suggest that a crop similar in size to 2022/23 could be in the cards, given rain patterns, flowerings, and tree conditions at this stage of the cycle. However, it is unclear whether such a crop would be sufficient to alleviate inventory issues, even if fruit quality and harvest size were both satisfactory. The increasing dependence of the US on imports, ongoing challenges in Mexico with lower productivity, and the absence of other suppliers mean that Brazilian supply will probably remain tight into 2023/24. A couple of sizable harvests will be needed to rebalance the market to a more neutral position, unless of course global demand falls much faster than expected due to high prices, which is a real risk for the OJ category.

Global Outlook

The global OJ market will see limited relief in the short term from the current supply squeeze. Inventories will remain constrained for some time and even with positive news out of Brazil, the market fundamentals are supportive of high prices during 2023/24. However, the demand-side risks should not be underestimated. A ‘weaker’ consumer in Europe and North America, already feeling the effects of inflation, could reduce OJ consumption at an even faster pace in 2H 2023 and cause the market to be more balanced – more quickly than current estimates. This could bring prices to a still high, but more moderate level, compared to the record prices seen in Q1 2023. For now, the base case is for elevated prices for longer, but demand destruction at high prices is a growing risk for volume sales this year.

Click here to download the report (link not for publication)

For more information

Please contact the report’s author:

Andrés Padilla, andres.padilla@rabobank.com, +55 11 5503 6936

Further information:

Rabobank press office, pressoffice@rabobank.nl, +31 30 216 2758

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com

For now, the orange juice market is staying tight for at least another season, unless there is a significant supply-side surprise for the 2023/24 harvest in Brazil or a much sharper contraction in global demand in 2H 2023.

According to a recent Rabobank report, record-high orange juice (OJ) prices in 2023 are a consequence of a very tight market, with smaller-than-expected production and low inventories. However, the decline of OJ demand is set to accelerate this year, in the face of high prices and weaker consumer demand, which will, in part, allow the market to find an equilibrium at high levels. Prices will probably remain high, at least until forecasts for the 2023/24 Brazil harvest provide more clarity on supply relief.

“We see very low inventories from two consecutive small harvests in 2020/21 and 2021/22, plus worsening news for the current 2022/23 season,” says Andrés Padilla – Senior Analyst at Rabobank. “This created the perfect environment for OJ prices to see a significant rally this year, surpassing levels last seen back in 2017 and climbing toward all-time highs.”

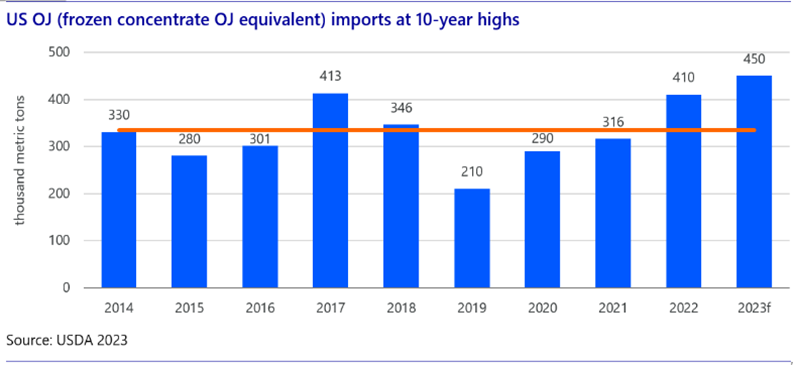

US imports rise

The global OJ market is under supply stress, and the lack of clarity regarding when inventories will be replenished is increasing the upward pressure on prices. In addition, the ongoing decline of production in Florida has meant that

US imports have been rising over the past four years, adding demand for exports from Brazil. The base assumption here is that the US will remain primarily dependent on imports in the coming years, as there is no clear path for a sustained recovery in Florida under current conditions. Significant additional investments would be required to increase production, but rising production costs are making new investments in orange groves less attractive.