Results at a glance:

- End of year delivers small turnaround in Australian rural confidence.

- Sentiment mixed across the nation, with half of the states reporting improved confidence and half a decline.

- Confidence lifted in the sheep and sugar sectors, although grain, beef, dairy

and cotton sector sentiment eased.

Australia’s farmers are approaching the end of the year with a hint of improving optimism as rural confidence levels nudge slightly higher in the latest quarter.

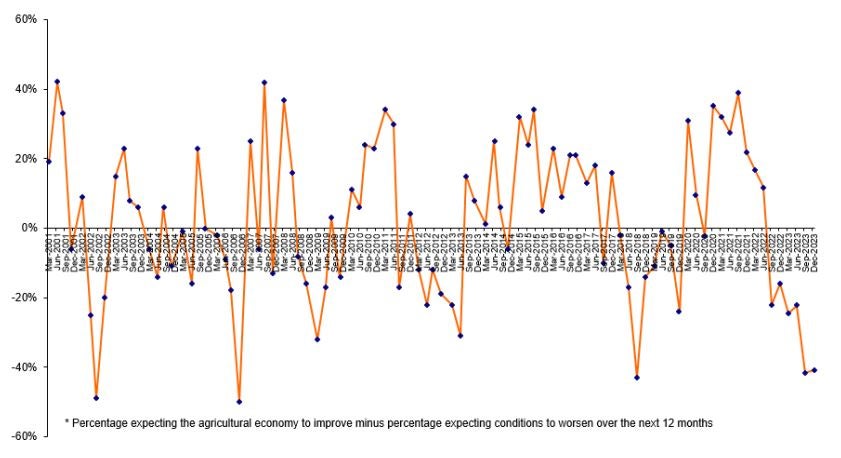

The Q4 Rabobank Rural Confidence Survey, released today, found net level farmer confidence across the nation edged up marginally, after having dropped to the fourth lowest level in the survey’s history in the previous quarter.

Sentiment was mixed across the nation, with Victoria, Western Australia and Tasmania reporting lower farmer confidence levels. But this was offset by an improved outlook reported by primary producers in New South Wales, South Australia and Queensland.

Overall, expectations around commodity prices were cause for optimism among those farmers with a positive outlook – particularly in the dairy and sugar sectors – while good seasonal conditions were nominated as a driver of confidence by 30 per cent of farmers expecting the agricultural economy to improve in the coming 12 months.

However, worries about the softening of commodity prices – as well as the spectre of drought, with an El Niño now declared – were also the key factors weighing on rural sentiment, for those farmers looking ahead with a pessimistic view.

The latest survey, completed last month, found 14 per cent of Australian farmers were now expecting the agricultural economy to improve in the next 12 months, up from 10 per cent with that view last quarter, while 27 per cent expected economic conditions to remain stable.

The largest percentage of farmers though (55 per cent) still anticipate economic conditions will worsen. And this had also risen (from 51 per cent the previous quarter). More farmers put down their negative outlook to softer commodity prices (64 per cent, up from 60 per cent) and worries about drought (45 per cent, was 32 per cent).

However, concerns around overseas markets/economies and rising interest rates lessened.

While commodity prices were also the dominant cause for optimism for those farmers with a positive outlook on the year ahead (nominated by 61 per cent), these producers were also hanging their hopes on a better season (30 per cent, up from 19 per cent in the previous survey).

Rabobank group executive for Country Banking Australia, Marcel van Doremaele, said this reflected the mixed seasonal conditions experienced across the nation.

“The anticipated – and later declared – return to El Niño conditions had dampened spirits in our quarter three survey,” he said.

“Since then, climate-wise we’ve seen a range of conditions around the country with everything from severe bushfires, to damaging summer storms, to heat events, to welcome rain for some areas offset by ongoing dry conditions elsewhere,” he said.

“Western Australian, Victorian and Tasmanian farmers, in particular, are assessing the fall out of a very dry finish to spring. Many South Australian producers had a better-than-anticipated harvest result, although some did have to contend with late frosts and summer hailstorms, and now heavy early December rainfall.

“This was offset by a general lift in farmer confidence in New South Wales on the back of recent rainfall in central and northern parts of the state after a very dry run. Drought remains the chief concern in Queensland although there has been useful – albeit patchy, summer storms.”

Put together, Mr van Doremaele said, these seasonal signals had buoyed the sentiment of those fortunate enough to receive beneficial rain, but intensified concerns about a dry year ahead for others.

Lower commodity prices remain top-of-mind for livestock producers nationally, especially for beef producers, albeit with some strength returning to the market in recent weeks.

Mr van Doremaele said these seasonal and market factors had worked in tandem – compounded by increased global supply – to contribute to a forecasted drop in value of Australian agriculture production for 2023-24.

“Drier conditions during the El Niño period will impact the record-high crop production levels seen in 2022-23, and Australian crop production values are expected to fall by $12 billion in 2023–24, according to ABARES. Livestock production values are also forecast to decline, based on recent market conditions.”

States

New South Wales was one of three states this survey reporting an improvement in farmer confidence. There was increased concern about drought (although this is expected to be alleviated in the areas which received good rainfall following the survey period), but NSW farmers were optimistic that commodity prices have finally reached the bottom and are set for a turn-around.

Also holding a more optimistic outlook were South Australian farmers, as they moved away from the uncertainty of spring, got a handle on the 2023 harvest and set their hopes on an end to the downward cycle of livestock prices.

The lift in confidence was more marginal in Queensland – with the state’s farmers reporting a slight uptick in optimism, supported by hopes of a good season.

The other three states recorded a drop in farmer confidence.

Leading the way was Tasmania, where rural sentiment fell to a survey-low level. There was heightened concern about the double-whammy of falling commodity prices and poorer weather conditions, with seasonal concerns nearly doubling from last quarter.

Victorian farmers also continue to take a more negative outlook on agribusiness conditions. Mr van Doremaele said while predictions of potentially drier seasonal conditions had contributed to the decline in sentiment among the state’s farmers, many parts of Victoria have enjoyed a good to average season.

The decline in farmer confidence in Western Australia was found be primarily on the back of mixed seasonal conditions and lower commodity prices coming off two previous record years, and uncertainty about the future of the live export market was also weighing on the state’s rural sector.

Commodities

“Although commodity prices paired with seasonal concerns are the underlying drivers of sentiment this quarter, drilling down into individual commodities reveals the diversity of market conditions facing Australian farmers,” Mr van Doremaele said.

Confidence in the grain sector dipped this quarter, with nearly half of growers now expecting conditions to worsen (was 43 per cent).

“This is where global factors really hit home for Australian growers, as the supplydemand tussle for grains and oilseeds are better balanced than the previous two seasons, pushing prices relatively lower,” Mr van Doremaele said. Though local grain prices remain well supported, he said.

After a tough run for Australia’s sheep producers, Mr van Doremaele said, confidence was shown to be starting to improve in the sector in the latest survey.

“We can thank rainfall events across the east coast for an improvement in markets as producers have more confidence to retain stock after a period of destocking,” he said.

“Improved feed availability prospects have increased demand pressure, especially for lighter stock. However, this price rise is expected to be tempered with the seasonal influx of stock into the market, through summer and into autumn.

“Wool producers also face a market which continues to stabilise against the bearish demand backdrop.”

The Australian beef sector experienced a shift the other way, with confidence deteriorating this quarter after considerable price decline over the course of the year, albeit with a turnaround underway since November.

While most drivers of sentiment were unchanged this quarter for beef producers, there was an increase in concern voiced about drought.

“It really is a case of ‘just add rain’,” Mr van Doremaele said. “We’ve seen the influence of producer sentiment on the market this month. Although the rain which has fallen over eastern and northern Australia over the past weeks was too late to influence beef sector confidence in the latest survey, it has corresponded to a larger jump in cattle prices – particularly young store stock.

“Hopefully this improves producer outlook, especially if there is timely follow-up rain.”

Despite strong milk prices – supported by marginally-higher production this year – dairy farmers were more pessimistic this quarter, with more than half of respondents expecting conditions to worsen.

Cotton growers were among the least optimistic this survey, with net confidence falling from five per cent last quarter well into negative territory (-38 per cent).

“Continued weakening global demand outlook for cotton, coupled with improvement in supply forecasts, have taken the spring out of the market that was seen in recent months,” Mr van Doremaele said.

Sugar growers’ sentiment improved in the quarter, primarily fuelled by positivity about high commodity prices.

Investment

Mr van Doremaele said the forecast drop in value of Australian agriculture production for 2023-24 will see farmers continue to tighten their belts when it comes to financial decisions.

Income expectations are down across the board with just 11 per cent of farmers surveyed expecting their incomes to increase in the coming 12 months (down from 14 per cent with that view in the previous quarter) and 66 per cent expecting their incomes to decrease (from 54 per cent last survey).

“As production values fall, so do farm incomes, and we see this play out in farmers’ investment intentions,” Mr van Doremaele said.

While 15 per cent of respondents still intend to increase investment in their farm businesses (unchanged quarter-to-quarter), more will look to decrease investment over the next year (29 per cent, down from 22 per cent last quarter).

For those who are planning to up their investment levels, there was a move away from building on-farm infrastructure such as yards, silos and fences – dropping from 67 per cent to 52 per cent – and fewer also plan to invest in increasing labour (14 per cent, was 20 per cent).

Forecast dry conditions pumped up enthusiasm to invest in irrigation/water infrastructure – nominated by 38 per cent of farmers with an increased appetite to invest (up from 27 per cent last quarter).

“Farmers have been increasingly cautious on all spending – taking into account reduced incomes and seasonal conditions – and are focusing investment on essential activities, such as infrastructure and technologies, which will help droughtproof their businesses,” Mr van Doremaele said.

With reduced cashflow, an increasing number of farmers expect to borrow more in the coming year (30 per cent, up from 18 per cent).

This debt is earmarked for working capital, with this purpose nearly doubling from 30 per cent to 57 per cent of those farmers who are borrowing more.

Far fewer farmers are looking to invest their additional borrowings in on-farm capital (19 per cent, down from 42 per cent) and there was reduced appetite to purchase property to expand operations (14 per cent of those who are borrowing more, down from 20 per cent).

Despite another rate rise during the survey period, Australian farmers reported being less worried about rising interest rates, with only 13 per cent of those with a pessimistic outlook on the year ahead nominating interest rates as a factor of concern, compared with 17 per cent the previous quarter.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the Rabobank Rural Confidence Survey has been conducted since 2000 by an independent research organisation. The next results are scheduled for release in March 2024.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com