Results at a glance:

- Australian rural confidence surged back into positive territory for the first time in nearly two years.

- Seasonal conditions and rising commodity prices underpin improved sentiment.

- The upward trend, following a decline in farmer confidence last quarter, occurred across every state.

Australian farmers have begun the year with a surge in confidence, riding on the back of widespread, better-than-expected summer conditions and positive signs from key commodity markets.

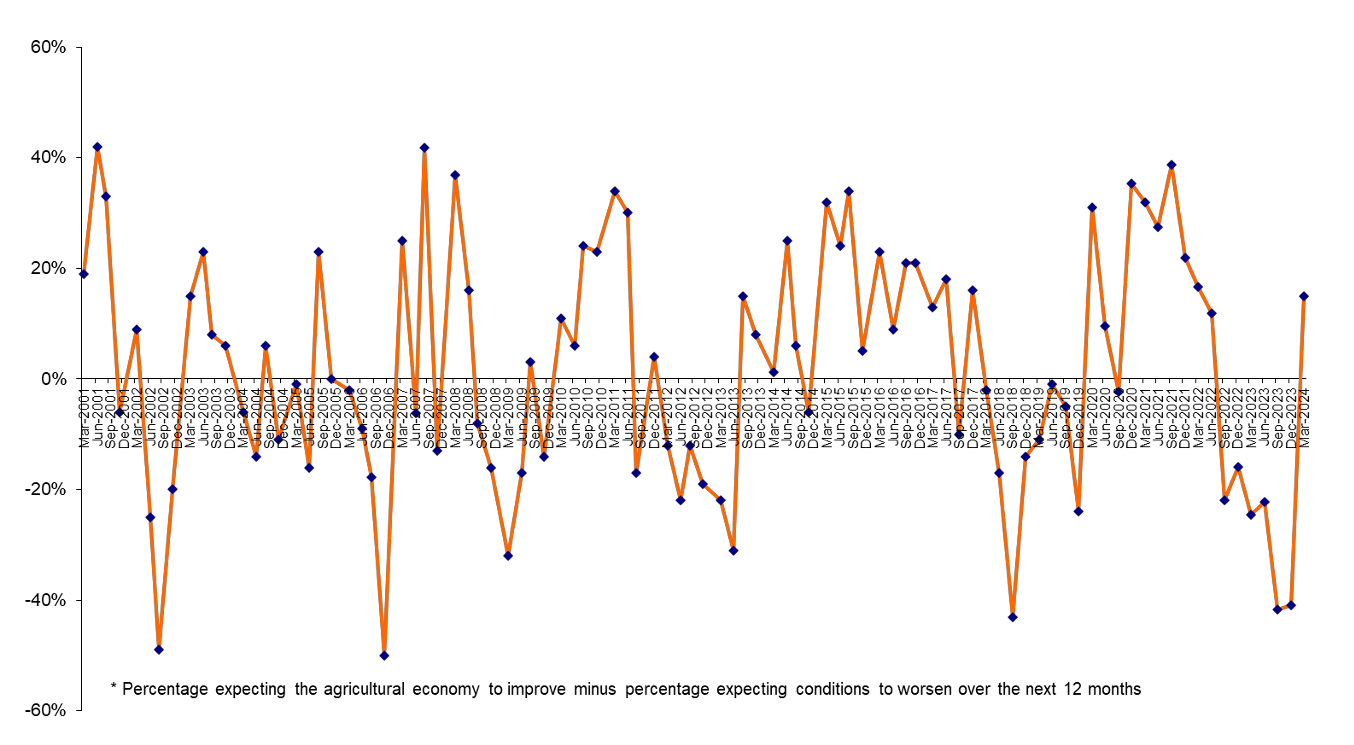

The latest quarterly Rabobank Rural Confidence Survey, released today, found national farmer confidence has returned to “positive territory” for the first time since June 2022, with more farmers now optimistic than pessimistic about the year ahead.

Net national rural confidence rose significantly from a reading of -41 per cent in the last quarter of 2023 to 15 per cent in the first quarter of 2024.

Nearly a third of farmers across the nation (31 per cent) expect the agricultural economy will improve over the next 12 months – more than double last survey (14 per cent). There was also a significant drop in the number who anticipate conditions will worsen – down to 16 per cent from 55 per cent.

Farmer confidence lifted across the country, although Tasmania and Western Australia were the only two states where confidence remained at net negative levels, despite seeing sentiment rally considerably since the end of 2023.

Rising commodity prices topped the list of reasons Australian farmers gave for their positive outlook (nominated by 58 per cent of those expecting the agricultural economy to improve).

Farmers were also increasingly positive about seasonal conditions – cause for optimism among 40 per cent of those expecting a better year ahead.

Rabobank group executive for Country Banking Australia, Marcel van Doremaele said one of the key reasons Australian farmers have moved confidently into 2024 was in response to better-than-expected seasonal conditions through summer.

“This – along with expectation of positive farm margins for the year ahead – has driven the most significant turnaround in confidence we’ve seen in several years,” he said.

Mr van Doremaele said the surge in farmer confidence followed two years where rural sentiment had “languished in negative territory”, corresponding to falls in the red meat markets, higher interest rates and rising input costs.

Sentiment had then stagnated at low levels in late 2023, as farmers faced uncertainty about how the declared return to El Niño conditions would play out.

“Summer certainly presented some weather challenges, with four cyclones making landfall in the 2023/24 wet season, major storm damage and extreme heat and bushfires,” he said. “However, most farmers emerged relatively unscathed from what they anticipated to be pretty dire conditions through summer as significant rainfall was received across many farming regions.

“This buoyed the optimism of those fortunate to receive the rain, but there are still regions where farmers remain concerned about dry conditions. The dry summer has taken its toll in Tasmania and WA in particular, where confidence levels are lagging the rest of the nation.”

Mr van Doremaele said it was pleasing to see areas of WA had received significant falls of rain in late February which will set up the state’s grain growers as they head into the sowing window for winter crops.

The latest survey, completed last month, found with summer rainfall topping up sub soil moisture in many of the nation’s cropping zones and delivering a boost to the feed base across grazing regions, drought had fallen away as a concern for those farmers who believe the agricultural economy will worsen – nominated by just eight per cent this survey, down from 45 per cent in the last quarter of 2023.

There was also a drop – although not as steep – in those concerned about falling commodity prices. This was now a factor for 45 per cent of farmers who expect the agricultural economy to worsen over the next 12 months, after spiking at 64 per cent in the previous survey.

“Although agricultural commodity prices remain well below the highs we saw in 2022, the outlook is more positive for this year,” Mr van Doremaele said.

“In particular, beef and sheep prices are set to be above the lows we saw last year, and that has driven up the confidence of red meat producers.

“The market is starting to re-set following the high volumes of livestock which hit the market last year and which, paired with the dry outlook, had depressed prices. We’ve already seen price gains this year for beef and sheep off the back of strong rainfall and re-stocker demand returning.”

More farmers reported being concerned about rising input costs this survey (cited by 37 per cent of those with a negative outlook on the year ahead, up from 28 per cent in the previous quarter), while overseas markets/economies were also an increasing worry (for 18 per cent, up from nine per cent).

However, concerns about the impact of rising interest rates eased slightly and worries about the Australian dollar remained at low levels.

States

Victorian farmer confidence rose to the highest level nationally, jumping from a net -39 per cent to 21 per cent, driven by anticipation of favourable seasonal conditions and commodity prices for the year ahead. Victorian sheep producers were the most optimistic of the state’s farmers this quarter, as they hold onto hope the market will provide more promise than the variable conditions experienced in 2023.

New South Wales farmers delivered the largest jump in confidence nationally, rising from -46 per cent last quarter to now sit as 20 per cent. Spirits were buoyed by good summer rainfall in many areas – although there are still isolated pockets waiting for rain – and improving commodity prices, with the states’ beef producers most optimistic in their outlook.

South Australian confidence lifted from -31 per cent to 19 per cent this quarter. Farmers have moved away from the uncertainty they felt at the end of 2023 around how El Niño would play out and are buoyed by the early, strong grain harvest, positive price signals in the red meat market and rain events through summer.

Also holding a more optimistic outlook were Queensland producers. Their confidence rose from net -31 per cent to 15 per cent this quarter. A solid start to the season with widespread rain and steadily improving commodity prices – particularly for cattle – drove confidence in this state.

Although Tasmania still recorded net negative confidence this quarter, overall sentiment lifted significantly from net -62 per cent last quarter to -7 per cent this quarter in the second highest turn-around after NSW. Although falling commodity prices remain the leading issue for Tasmanian producers who expect conditions to worsen, their concerns have eased. Despite dry conditions prevailing in Tasmania during the survey period, concerns around drought being a factor for the year ahead also declined.

Western Australia also recorded net negative confidence this quarter although sentiment improved, lifting from -59 per cent to -17 per cent. Commodity prices remained a cause for concern, but there was easing disquiet around the weather as farmers move away from a very dry summer and look ahead to the seasonal break. The intertwined factors of threats to live export and government interventions/policies vied for second place for why WA farmers expect economic conditions to worsen.

Commodities

Confidence in the red meat industries took a significant turn for the better this quarter. Nationally, net confidence in the sheep sector bounced back from -45 per cent at the end of 2023 to 27 per cent this quarter, and net confidence among beef producers jumped from -40 per cent to now sit at 29 per cent.

Beef producers expect rising commodity prices and positive seasons will drive improvements in the agricultural economy, with the sector riding on more bullish market conditions and beneficial summer rain. Concern around drought also eased.

“Domestic re-stocker interest helped drive a lift in beef prices by more than 50 per cent since October,” Mr van Doremaele said.

Sheep producers are hanging their hopes on rising commodity prices – nominated by 59 per cent who think the economy will improve, while 27 per cent credit their positivity to expectations of a good season.

“While sheep prices haven’t seen the same lift as cattle prices and they have dipped a bit since the start of the year, they are still performing better than the lows of last year,” said Mr van Doremaele. “This gives producers confidence of a better year ahead, especially in tandem with improved seasonal conditions.”

Australian grain growers were more tempered in their outlook. Although confidence did increase this quarter from -38 per cent to -15 per cent, of those grain farmers who think the economy will worsen, concerns around falling commodity prices and rising input costs remain high.

However, Mr van Doremaele said, there was good news for grain producers when it comes to farm input prices.

“Although grain producers are likely to remain under pressure as a result of plentiful global and local supply, there’s a silver lining as farm input prices for fertilisers and plant protection products are forecast to be below last season,” he said. “This, combined with useful rainfall in many grain-growing regions, sets growers up to more optimistically plan – compared to the same period last season – for the upcoming planting period for winter crops such as wheat, barley and canola.”

Confidence among dairy farmers increased as they look ahead to the new season milk price, with their net confidence level lifting from net -42 per cent to -7 per cent.

“Dairy margins are tipped to remain positive thanks to ongoing domestic support for farmgate prices,” Mr van Doremaele said.

After some challenges this season for southern cotton regions – countered by better conditions in Queensland – the confidence of cotton growers nationally edged into positive territory, lifting from net -38 per cent to two per cent this quarter. The optimistic outlook rests on firmer cotton prices and the availability and affordability of water.

Investment and income

The positive seasonal and economic outlooks combined to firm up investment intentions for Australian farmers in the year ahead.

A total of 21 per cent of farmers indicated they are looking to increase investment in their business in the coming year (up from 15 per cent in the previous quarter) and only 12 per cent intend to decrease investment (down from 29 per cent).

“Farmers took a very conservative approach to spending last year, mindful of reduced incomes and the uncertain summer forecast, but they now have more confidence to boost their budgets following improved seasonal and economic outlooks which underpin positive farm margins in key agricultural sectors this year,” Mr van Doremaele said.

Farmers are ready to spend up big on silos, fences and yards, with 61 per cent who intend to increase their investment nominating on-farm infrastructure (up from 52 per cent last quarter).

Seasonal and market improvements also supported the intention to increase livestock numbers for around a third of farmers who are looking to increase their investment (34 per cent, up from 20 per cent).

In an industry plagued by ongoing skilled labour shortages, farmers intending to lift investment strengthened their plans to increase labour (21 per cent, was 14 per cent the previous quarter). Investment appetite though eased for irrigation/water infrastructure (24 per cent, was 38 per cent), new plant and machinery (35 per cent, was 44 per cent) and adopting new technologies (40 per cent, back marginally from 43 per cent).

Just over a quarter of respondents who are planning to lift investment are considering investing in property, which was virtually unchanged (26 per cent, was 24 per cent).

“We expect farmers to remain discerning when looking to purchase property this year, as they capitalise on more positive seasonal and economic signals to strategically expand enterprises,” Mr van Doremaele said.

Income expectations increased in line with overall confidence, with 31 per cent of Australian farmers expecting their incomes to rise in the coming year (was 11 per cent) and 25 per cent expecting incomes to decrease, a significant fall from 66 per cent last quarter.

“Farmers have emerged from a period of eroded confidence and reduced income, so it’s encouraging to see a lift in positivity about what the year ahead will bring,” Mr van Doremaele said.

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the Rabobank Rural Confidence Survey has been conducted since 2000 by an independent research organisation. The next results are scheduled for release in June 2024.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com