Global vegetable trade value rose amid cost increases; production down in some major markets.

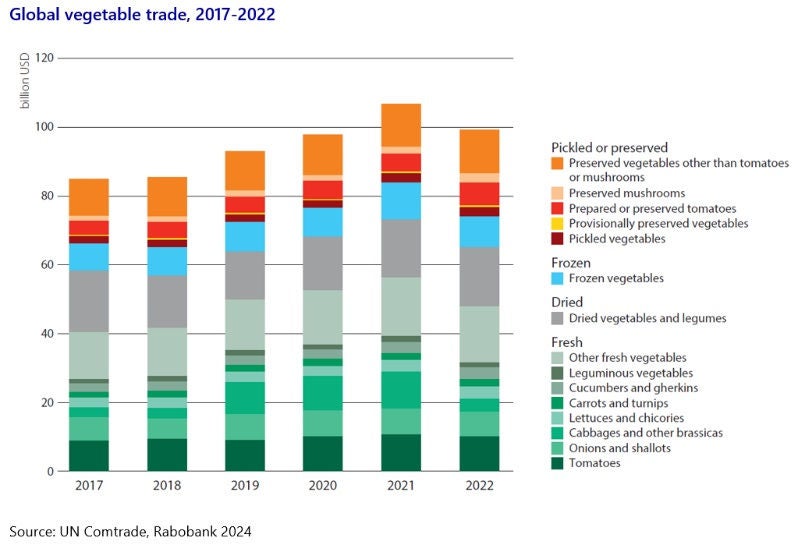

The value of the global vegetable trade rose in line with rising prices, reaching 3% average annual growth from 2017 to 2022, according to Rabobank’s recently-published World Vegetable Map.

The map and accompanying report – charting recent global vegetable production, consumption and trade – found production in the EU and the US saw declines over the same period, while global consumption held up relatively well, despite higher costs for consumers and producers alike.

The past five years have been everything but boring for the vegetable sector,” says Cindy van Rijswick, global strategist – Fresh Produce at Rabobank. “The Covid-19 pandemic, extreme weather events, skyrocketing costs for growers and challenging logistics are just some of the factors that have impacted the sector.”

Despite these challenges, global trade in both processed and fresh vegetables increased by an average of 3% per year from 2017 to 2022, though not in a linear pattern due to the Covid pandemic and subsequent inflation.

At its height, global trade was valued at USD 107 billion in 2021, passing the USD 100 billion mark for the first and only time.

Compared with trade, global vegetable production grew at a slower pace of 1.2% per year over the same period. Notably, the EU and the US both experienced declines in production.

Australia

The report says Australia’s per capita vegetable consumption had decreased between 2017 and 2022, despite being before high food price inflation had kicked in more recently.

“It seems that Australian consumers are shifting from purchasing greater volumes to focusing on higher-value vegetables,” it says. “While consumption of carrots, pumpkins and onions decreased, consumer interest in leafy greens increased.”

Although a small player in global vegetable trade, Australia is shown to punch above its weight when it comes to organic vegetables, commanding more than 5% of organic global vegetable trade (in 2021), according to the report.

In the 2023 financial year, according to Rabobank Australian analyst Pia Piggott, Australia overall produced AUD 5.8 billion worth of vegetables, although only AUD 250 million worth of these were exported.

“Horticulture exports are growing for Australia,” she said, “however, this is mostly in the fruit and tree nut categories, rather than vegetables.”

However, Ms Piggott noted, Australia is not the only country with low vegetable exports, with only 7% of world vegetable production traded between nations.

US largest import market for fresh vegetables; new players in fresh and processed trade

Ms van Rijswick said global vegetable trade mainly occurred within continents and often between neighbouring countries.

“Since 2017, the US has further cemented its position as the world’s largest import market for fresh vegetables, with a significant share of imports for greenhouse vegetables like cucumbers, tomatoes, and bell peppers. This has led to a nearly 40% increase in Mexico’s total fresh vegetable exports between 2017 and 2022,” she said.

“Mexico, Spain, and the Netherlands have remained relevant exporters in the world of fresh vegetables, and countries such as Turkey and Poland are becoming bigger producers and exporters of both fresh and processed vegetables.”

Poland, in particular, has evolved as both an importer and exporter, reflecting its growing significance as a central European trading hub. Meanwhile, in the processed vegetable market, China now exports more frozen vegetables than Belgium, the previous top exporter.

For more information Please contact the report’s authors:

Cindy van Rijswick, cindy.rijswick@rabobank.com, +31 6 12446402

David Magaña, david.magana@rabobank.com, +1 559 5136854

Gonzalo Salinas, gonzalo.salinas@rabobank.com

Lambert van Horen, lambert.van.horen@rabobank.com

Pia Piggott, pia.piggott@rabobank.com

Further information: Rabobank press office, pressoffice@rabobank.nl, +31 30 216 2758

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com