22/10/2024

Australia is looking towards harvesting a “marginally larger” winter crop this season, despite significant weather challenges experienced in a number of key grain-growing regions throughout the year, Rabobank says in its just-released 2024/25 Australian Winter Crop Forecast.

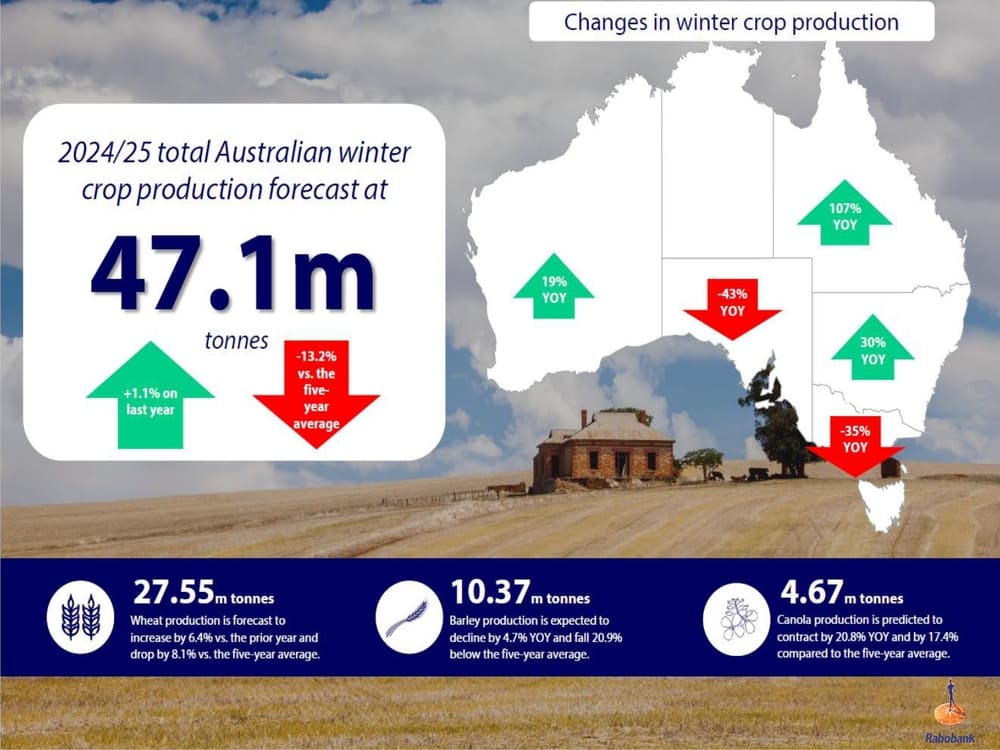

The agribusiness banking specialist says the nation is on track to produce an estimated total winter crop of 47.1 million tonnes, up one per cent (0.5 million tonnes) on the previous season, but down a significant 13 per cent on the five-year average.

A combination of lack of timely rainfall along with late frosts in some regions has taken the edge off this year’s production prospects, the bank says, with overall grain and oilseed production forecast to be down 43 per cent on the previous year in South Australia and 35 per cent in Victoria, two of the hardest-hit states.

Queensland, on the other hand, is set to be doing the heaviest lifting when it comes to production tallies, the report forecasts, with that state’s grain and oilseed totals estimated to be up a record-breaking 107 per cent on the previous season. New South Wales production is forecast to increase 30 per cent year-on-year and Western Australia, the nation’s largest grain-exporting state, is tracking towards a harvest 19 per cent larger than last, despite a worryingly late start to its growing season.

Report author, RaboResearch analyst Vitor Pistoia said the projected “small uptick” in total crop production in 2024/25 was “poised to come mainly from wheat” and, to a smaller extent, pulses and oats.

“While the wheat harvest is expected to be an improvement on last year, canola and barley production look set to be down year-on-year due to the combination of low rainfall and late frost which struck many crops at a critical period,” he said.

Weather woes

Mr Pistoia said this winter cropping season had been a “mixed bag”, characterised by patchy rainfall, a warm winter and late frosts.

A good start to the season and beneficial rainfall through the growing period in Queensland, northern New South Wales and some areas of Western Australia had largely been “counterbalanced” by a lack of rainfall that had impacted Victorian and South Australian crops, he said.

“This season’s start was variable across the country. While Queensland, the majority of New South Wales and one particular region in Western Australia (around Corrigin in the Central Wheatbelt) got going early on, large swathes of WA, Victoria and South Australia had to wait until early June to see seed germination,” he said.

“Similarly, rainfall through the growing season was patchy and this was coupled with a widespread warmer winter. Higher winter temperatures – of up to two degrees Celsius above average depending on the region – boosted water evaporation at the same time it prompted faster crop development.”

Then, in mid-September, Mr Pistoia said, the south-eastern part of Australia’s cropping belt – including in some areas of South Australia – had been struck by consecutive nights of late frost. “This cold snap damaged crops to differing degrees and prompted many farmers to cut them for hay, especially in the regions already affected by low rainfall volumes, such as Victoria and South Australia,” he said.

Commodities

The Rabobank report estimates Australia’s 2024/25 wheat production to total approximately 27.6 million tonnes, an increase of six per cent (1.6 million tonnes) on the previous year, albeit down eight per cent on the five-year average. Combined, Queensland, New South Wales and Western Australia’s increased wheat production is expected to be 5.7 million tonnes, while production in Victoria and South Australia declined.

Australia’s barley harvest is forecast to decline five per cent (0.5 million tonnes) on the previous year to 10.4 million tonnes (down 21 per cent on the five-year average). “This expectation is mostly due to the drop in the barley crop in Victoria,” Mr Pistoia said. Victoria’s barley harvest is expected to be down by one million tonnes on last season, at 1.7 million tonnes.

Similarly, total canola production is predicted to contract by 21 per cent (1.2 million tonnes) on last year’s harvest to 4.7 million tonnes (down 17 per cent on the five-year average). “As expected at the beginning of the season, canola production is poised to be lower this year, not only because of the smaller cropping area planted to this crop, but also due to the weather setbacks,” Mr Pistoia said.

Market outlook

Once harvested, Australia’s grains and oilseeds look set to trade in a relatively range-bound market when it comes to prices, the report says, with the exception of canola, where “market fundamentals” support an outlook for higher prices.

“The worldwide grain and oilseeds outlook has changed in recent months from a potential glut to a patchier stocks picture,” Mr Pistoia said. “An uncertain outlook for Black Sea wheat production due to dry weather is supporting wheat prices, although this is being buffered by notable increases in US wheat and corn stocks.”

Compared with the past 20 years, the 2024/25 projected global stocks-to-use ratios of wheat and corn are “virtually at their median point”, the report says, while soybeans and rice are above it. “This reinforces the relative ‘comfort zone’ the global market sees itself in,” Mr Pistoia said. “There are though some outlier crops in this picture within the oilseeds complex. Globally, stocks of sunflower and canola are projected to be tight due to weather problems and also geopolitical issues weighing on production.”

For wheat, the bank forecasts APW (Australian Premium White) port prices to range between AUD 320 and AUD 360/tonne by the end of 2024 until half way through the first half of 2025.

For barley, lower global stocks of the malting variety are supporting prices for some regions, although not for Australia, Mr Pistoia said.

“Despite the lower stocks, global demand for malting barley is also soft and in addition Australia’s distance from key markets puts us at a disadvantage,” he said. “However, the re-opening of the Chinese market to Australian barley producers is supporting the Australian barley demand outlook. Following the removal of Chinese tariffs on Australian barley, China regained its position as the number one destination for Australia’s barley exports in 2023/24.”

Based on current barley market fundamentals, the report has port zone feed barley forecast to trade in the AUD 290 to AUD 320/tonne range. “For malting barley, the outlook is to have minimal, if any, discount compared with APW wheat.

For cereal hay, assuming a slight increase in cattle and sheep prices and that feedlots maintain high numbers of cattle on feed during 2025, the bank is forecasting prices to likely range between AUD 350 and AUD 400/tonne. Although this may be adjusted by summer rainfall and the La Nina outlook, Mr Pistoia said.

For canola, the Rabobank report says, a combination of global geopolitics, bad weather and high farming costs has tempered harvest sizes.

“A wet summer in the EU and a hot dry one in the Black Sea region has exacerbated a supply shortfall of canola,” Mr Pistoia said. “In addition, the continuing solid demand for vegetable oil is sustaining canola demand, while the EU tariffs on Russian and Belarussian oilseed imports mean the EU now needs to source this supply internally or from other exporting countries.”

And with the European preference for non-GM canola, Mr Pistoia said, Canada, the world’s largest canola exporter, was not in a good position to fulfil this demand, despite rebuilding its stocks after a reasonable harvest.

“Putting all these elements into the picture, we expect Australian non-GM port prices for canola could range between AUD730 and AUD 780/tonne in the first half of 2025, and the GM canola price to potentially trade at an eight to 12 per cent discount to this,” he said.

States

Queensland’s 2024 winter crop production is looking on track to break the total production record and surpass the 2021 season as the biggest-ever crop in the state, the Rabobank report says. Total production for the season is forecast to come in at 3.6 million tonnes.

New South Wales is projected to have 14.6 million tonnes of total winter crops heading to its harvest bins this season. Mr Pistoia said growing conditions for winter crops had been good in the state until mid-September, except for in southern regions such as Albury. However, the mid-September frost events had impacted crops, particularly around areas including Forbes, Grenfell and Griffith, where there had been significant damage.

For Western Australia, the season “took a long time to start, but, when it did, it was for real”, Mr Pistoia said. This has put the state on track to see a recovery from last year’s diminished harvest – projected to be up almost 20 per cent on last season’s volumes to 17.3 million tonnes, and aligned to historic averages.

After five consecutive average to above-average winter crops, Victoria’s harvest this year is forecast to come in at just 6.8 million tonnes, down more than 35 per cent on the previous season. This is a consequence of the challenging conditions faced by the southern cropping belt so far this year, Mr Pistoia said, including a late seasonal break, low ‘growing season’ rainfall and late frosts.

South Australian grain growers have faced a similarly tough year, he said, with that state’s total harvest projected to be down more than 40 per cent to 4.9 million tonnes. “An unusually wet summer that required summer weed knockdowns was followed by a late season break and poor growing-season rainfall. Crop growth and development became even more difficult due to a warm winter, which reduced soil moisture faster than usual,” Mr Pistoia said.

This publication is for information purposes only. The contents of this publication are general in nature and do not take into account your personal objectives, financial situation or needs. As such, the contents of this publication do not constitute advice and should not be relied upon as a basis for any financial decisions. Rabobank Australia Limited ABN 50 001 621 129 AFSL 234700 and Coöperatieve Rabobank U.A. (Australia Branch) ABN 70003917655 AFSL 238446 (collectively referred to as, ‘Rabobank Australia’) recommend that you seek independent financial advice from your accountant or financial adviser before making any financial decisions related in any way to the contents of this publication. The information and opinions contained in this publication have been compiled or arrived at from sources believed to be reliable. Any opinions, forecasts or estimates made are reasonably held, based on the information available at the time of publication and there can be no assurance that that future results or events will be consistent with any such opinions, forecasts or estimates. All opinions expressed are subject to change at any time. No representation or warranty, either expressed or implied, is made or provided as to the accuracy, reliability or completeness of any information or opinions contained within the publication. You should make your own inquiries regarding the contents of this publication. Rabobank Australia does not accept any liability for any loss or damage arising out of any error or omission in the publication or arising out of any reliance or use of this publication or its contents or otherwise arising in connection therewith. This publication may not be reproduced or distributed in whole or in part, except with the prior written consent of © Rabobank Australia Limited ABN 50 001 621 129 AFSL 234700 and Coöperatieve Rabobank U.A. (Australia Branch) ABN 70003917655 AFSL 238446, as part of the Rabobank Group

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 37 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media Contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com