12/06/2024

Results at a glance:

- Australian farm sector confidence fell this quarter, after surging earlier in the year.

- Confidence was found to be down for all states and sectors, except for cotton.

- Dry autumn weather in some parts of the country – particularly in WA, SA and Tas – along with inflationary pressures, had weighed on farmer optimism this survey.

- More recent rainfall, though, has offered a reprieve for parts of the country.

- Farmers’ investment intention remain stable, at healthy levels.

Mixed seasonal conditions across the country – coupled with economic pressures – have seen the nation’s farm sector confidence take a U-turn in the latest quarter, declining after a resurgence in optimism at the start of the year.

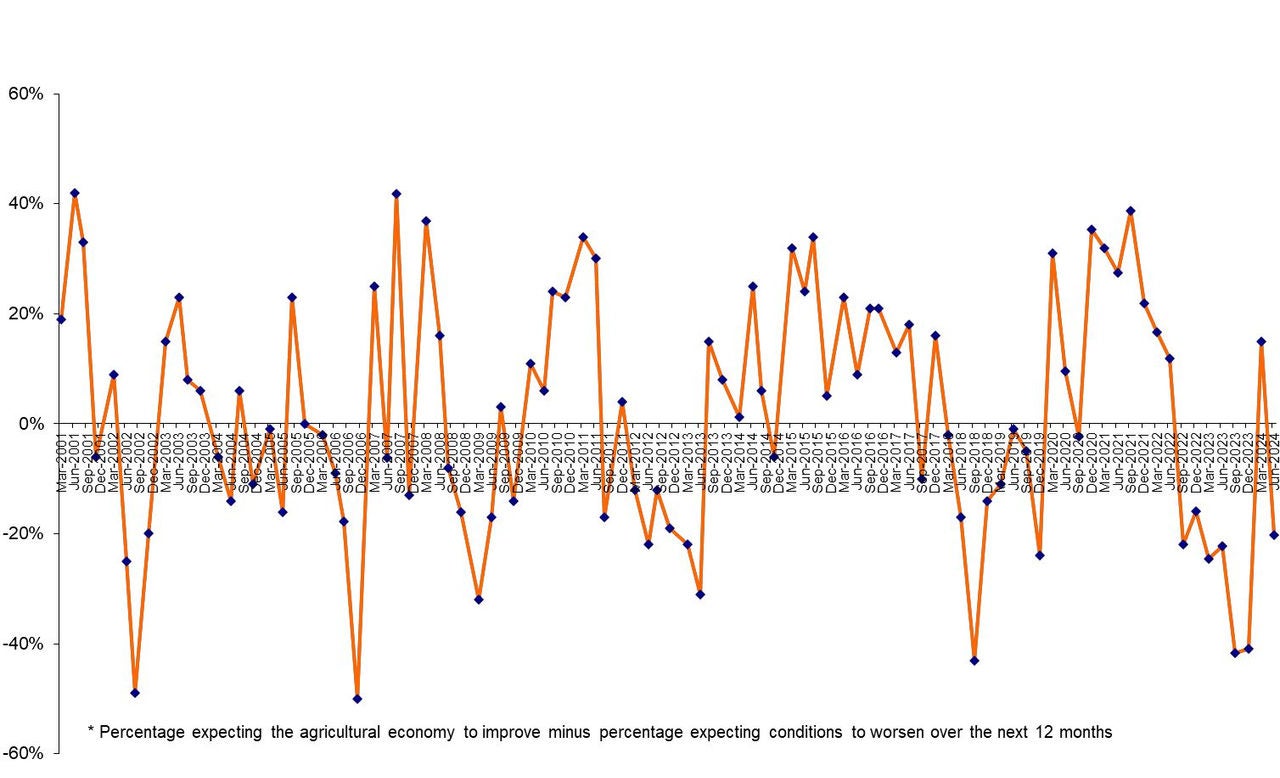

The quarter two Rabobank Rural Confidence Survey, released today, found sentiment among the country’s agricultural producers had dipped into ‘negative territory’ – with fewer farmers expecting a better year ahead than those holding a negative outlook.

This comes after a rebound in farmer confidence in the first quarter of the year, which had been driven by better-than expected summer rainfall and promising commodity markets.

Farmers in the west and south of the country had struggled through a very dry autumn, with many having worryingly late – or in some cases no – ‘autumn break’ for the start of winter cropping, although rainfall was much more plentiful in Queensland and many parts of New South Wales.

Meanwhile, the impact of economic pressures on farm business ‘bottom lines’ was also found to be an increasing concern, with worries cited about softer commodity prices in some sectors and inflationary pressures being felt in the form of high input costs.

Rabobank group executive for Country Banking Australia, Marcel van Doremaele said this quarter’s survey results reflected the “patchy” seasonal conditions that had been seen across different parts of Australia during autumn, after the nation’s farmers had begun the year with a large rebound in optimism following much-better-than-expected summer weather conditions.

Pleasingly, Mr van Doremaele said, many of the drier parts of the country had since received late rainfall events in recent weeks, which would be offering many farmers a reprieve, though some areas still remained in need of rain, particularly in parts of Victoria.

“And although confidence has come down from the high levels we’d seen at the beginning of the year, overall conditions in the agricultural sector are still good,” he said.

“There has been rainfall in many agricultural regions, setting up the planting conditions for the winter cropping season, while the potential of a La Nina developing in the second half of the year is holding additional promise.

“And commodity prices – while down from the very high levels seen a couple of years ago – are overall reasonable, for example in grain, dairy and cotton. Although farmgate milk prices will be lower in the season ahead, the dairy sector is still looking to a profitable year ahead and for beef producers, there is the outlook for stronger demand from the US coming through later in the year to provide some further price support.”

The survey, completed last month, found those Australian farmers expecting the agricultural economy to improve in the coming 12 months had declined to 15 per cent (from 31 per cent with that view in the previous quarter). And more than a third of respondents (36 per cent) were now expecting conditions to worsen – up from 16 per cent.

A total of 46 per cent though had a stable outlook on the year ahead, anticipating the agricultural economy to remain the same.

Mr van Doremaele said a late autumn break had especially pushed down rural confidence levels in South Australia, Western Australia and Victoria, with the survey aligning with a concerningly-dry seeding period in those states. “Tasmanian farmers had also faced below-average seasonal conditions, with low rainfall, through to the start of winter,” he said.

While weather conditions have been more favourable in New South Wales, Mr van Doremaele said, this had varied greatly across the state, with parts of the Northern Tablelands, the Monaro and eastern Riverina facing dry weather, with little quality pasture growth coming into winter.

“Queensland has been enjoying good to very good seasonal conditions in a large part of the state, with high rainfall totals, but the subdued cattle market has been weighing on producer sentiment there,” he said.

Drought/dry weather conditions was nominated as the biggest concern by farmers this survey (cited by 37 per cent), followed by rising input costs (35 per cent) and falling commodity prices (32 per cent).

Australian farmers were also mindful of the impact of government intervention and policies and overseas markets/economies – rated as a cause for concern by 24 per cent and 21 per cent, respectively.

“Although the formal announcement of when live export of sheep will cease hadn’t been made during the survey period, the issue has been weighing heavily on the minds of sheep producers, especially in WA where alternative markets are limited,” Mr van Doremaele said.

There was, though, still significant cause for optimism identified among farmers in the latest survey, with 37 per cent expecting a good season ahead and 28 per cent anticipating rising commodity prices.

States

Farmer confidence was shown to be down across all states, though remained at comparatively higher levels in New South Wales and Queensland.

New South Wales rural confidence fell from net 20 per cent last quarter to -11 per cent. NSW farmers were most concerned about rising input costs, with drought coming in at second place (reflecting regional variability) followed by commodity prices.

Although much of Queensland has experienced better than-average to average seasonal conditions and producers had been receiving reasonable commodity prices in a number of sectors, high input costs took the shine off the outlook for the year ahead, cited as the leading concern. Net confidence fell from 15 per cent last quarter to -13 per cent this survey.

Victorian farmers continued to ride the confidence roller coaster. Farmer sentiment decreased from net 21 per cent last quarter to -31 per cent this quarter, pushed down by dry weather conditions, falling commodity prices and rising input costs.

South Australian rural confidence also dived from net 19 per cent to -38 per cent – to make it the lowest nationally – driven down by below-average rainfall while winter crops were sown. Drought was the leading cause for concern during the survey period, listed by nearly half of SA respondents.

The smallest shift in net rural confidence occurred in Western Australia, where sentiment fell from -17 per cent to -21 per cent. Government interventions/policies led the list of concerns, followed by drought, falling commodity prices and rising input costs.

Despite struggling through dry autumn across much of the state, Tasmanian farmers recorded the second smallest decline in farmer optimism, with net confidence falling from -7 per cent to -16 per cent.

Commodities

All commodity sectors surveyed reported lower confidence levels, with the exception of cotton.

“Despite a mixed start to the grain season across the country, Australia’s crop planting is estimated to be up more than three per cent compared with 2023,” Mr van Doremaele said. “After the tough start in WA, SA and western Victoria, farmers are looking to a mid-to-late season boost following better rainfall due to a potential La Niña.”

For dairy, he said, lower minimum milk prices across parts of the manufacturing-exposed sector will impact on dairy producer margins. However, the sector overall is still forecast to have another profitable year ahead.

Cotton growers were the most optimistic of all Australian farmers this quarter, with net confidence tracking upwards, based on expectations of a good season and rising commodity prices. There were regional impacts, Mr van Doremaele said – “for example, some Queensland cotton growers faced yield downgrades from late summer storms while others were buoyed by full water allocations for the season ahead, and NSW growers enjoyed a strong yield compared with last year although there were rain delays to picking”.

For beef, Mr van Doremaele said, “while the cattle market lifted earlier this year, there’s room for improvement, with producers citing concerns about soft cattle prices as well as the prospect of dry seasonal conditions returning in the survey”.

Confidence among sheep producers was shown to have slumped this quarter, with 45 per cent of producers expecting conditions will worsen and only eight per cent looking to an improvement. Dry conditions in WA, SA and Tasmania contributed to this decline in confidence, paired with the impact of rising input costs and threats to the live export market.

“The extended dry in some regions meant sheep producers who had been containment feeding faced higher-than-expected feed bills,” Mr van Doremaele said. “This, paired with a sheep market which hasn’t really picked up this year, has impacted profit margins. And, although the recent news that WA live sheep exports will cease in May 2028, is no surprise, it has not helped the situation for the sheep sector and a third of sheep producers nationally are concerned about overseas markets.”

Investment and incomes

Australian farmers’ investment intentions remained stable quarter-on-quarter. More farmers planned on increasing their investment (unchanged from last quarter at 21 per cent) than decreasing it (13 per cent, was 12 per cent last survey).

On-farm infrastructure – such as fences, yards and silos – was a focus, with 61 per cent of farmers across the country identifying this as an area for investment.

Adopting new technologies was the second highest planned investment (36 per cent), followed by irrigation/water infrastructure (24 per cent).

A similar number of farmers plan on investing in new plant and machinery (22 per cent), education (22 per cent) and increasing livestock (20 per cent). Most of the interest in increasing livestock came from NSW and Queensland, reflecting favourable seasonal conditions in these states.

Property purchase was planned by 11 per cent in the coming 12 months, with Tasmanian and WA farmers showing the strongest appetite for land (17 per cent and 16 per cent, respectively).

“Property markets in some states are moving into a period of consolidation, and producers are taking into account interest rates and what rates are forecast to do,” Mr van Doremaele said.

With the easing in confidence levels, farmers reported lower income expectations, with 21 per cent indicating they expect their income to rise (down from 31 per cent in quarter one) and 32 per cent anticipating a decrease in income (was 25 per cent).

A comprehensive monitor of outlook and sentiment in Australian rural industries, the Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The most robust study of its type in Australia, the Rabobank Rural Confidence Survey has been conducted since 2000 by an independent research organisation. The next results are scheduled for release in September 2024.

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 37 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media Contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com