31/10/2024

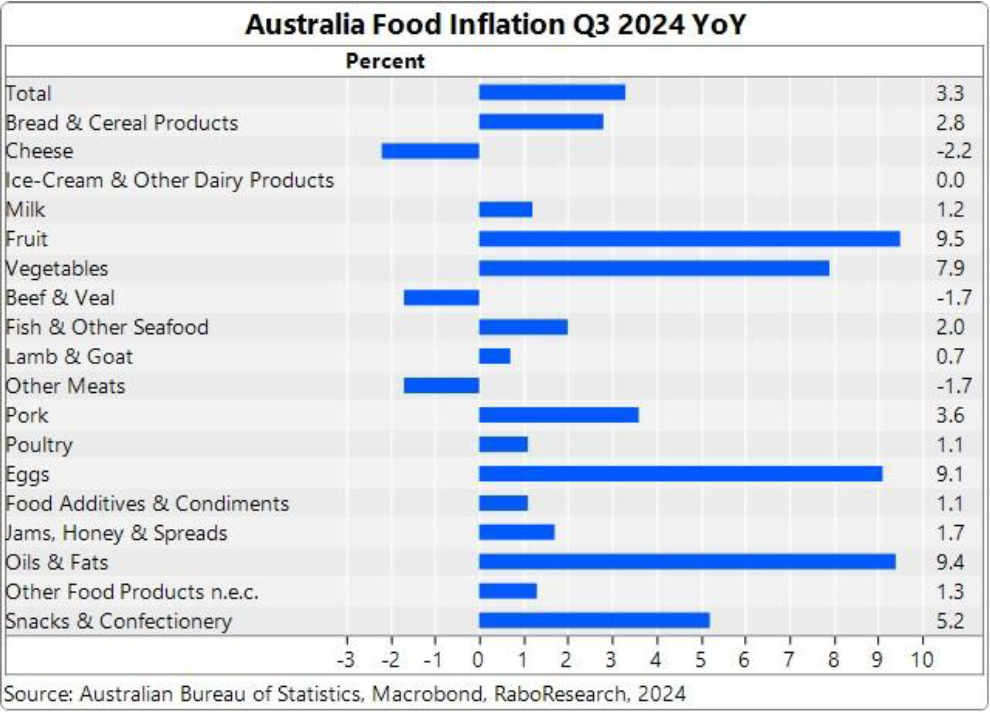

While overall headline inflation eased in the latest quarter, the annual rate of food price inflation held fast at 3.3 per cent, the latest quarterly Consumer Price Index (CPI) data, from the Australian Bureau of Statistics, has shown.

The recently-released September 2024 quarter data, saw overall annual food price inflation – comparing prices with the September 2023 quarter – remain at the same rate (3.3 per cent) seen in the June quarter. Quarter on quarter, prices in the ‘food and non-alcoholic beverages’ category rose 0.6 per cent.

RaboResearch senior food retail analyst Michael Harvey said the annual rate of food price inflation was “still higher than average”, with the 10-year average tracking at 2.7 per cent.

Mr Harvey said a spike was seen in annual price inflation for fresh produce overall (both fruit and vegetables), at 8.6 per cent. However, he said, this needed to be seen in the context of a “weak comparable” in September 2023, when prices were down (-6.4 per cent) on the previous year.

“For the September 2024 quarter though, the ABS (Australian Bureau of Statistics) does cite higher prices for berries, grapes, tomatoes and capsicum contributing to the rate of inflation in this category due to unfavourable growing conditions,” he said. “However, with the summer season now approaching, we are starting to see good volumes and lower prices in some fruit and vegetable products.”

There was, though some good news for consumers when it came to food prices, Mr Harvey said, with a general moderation in inflation across many key categories – including bread, spreads and condiments – and some “limited price deflation” (lower prices) in categories, including beef and veal and cheese.

“For dairy, there has been promotional activity in the cheese category which has been a driver in some of the lower pricing seen here,” he said. “And it is expected lower retail milk prices we have seen on some supermarket shelves in recent weeks will come through in the December quarter CPI data.

“While butter is not a specific item measured in CPI data, consumers are paying higher prices in this category. As a sizeable importer of butter, record-high global butter prices are being felt in supermarket shelves here.”

In more bright spots for consumers, Mr Harvey said, annual inflation in the food service category had moderated to 2.9 per cent in the September quarter, compared with the June quarter, where food service prices had increased 4.2 per cent year on year.

There were though “some problematic categories” worth noting in the latest CPI data when it came to food prices, he said.

“Cooking oils remain a clear ‘red flag’ for consumers with an annual inflation rate of 9.4 per cent. While this is a lower rate of inflation than seen in the previous quarter, it follows on from two years of high inflation in this category – on a cumulative basis, quarterly price inflation is running at +42 per cent since March 2022. This reflects the impact of global supply shocks in cooking oil,” he said.

Mr Harvey said there had also been an uptick in the rate of inflation in the snacks and confectionery category – annual price rises of 5.2 per cent in the September quarter compared with 4.6 per cent in the June quarter – as “the impact of higher global cocoa prices feeds through”.

The annual inflation rate for egg prices also increased this quarter, to 9.1 per cent compared with an annual rate of 6.5 per cent in the June quarter.

“And with all these categories – cooking oil, snacks and confectionery and eggs – consumers have been seeing prices rise since 2022,” he said.

Overall, Mr Harvey said, the cost of the average food basket for Australian households was “still very high and likely to remain high in the near term”.

“Consumers are continuing to respond with their food purchasing choices. There is a big focus on promotion and activity to cater to the value-conscious consumer.”

This publication is for information purposes only. The contents of this publication are general in nature and do not take into account your personal objectives, financial situation or needs. As such, the contents of this publication do not constitute advice and should not be relied upon as a basis for any financial decisions. Rabobank Australia Limited ABN 50 001 621 129 AFSL 234700 and Coöperatieve Rabobank U.A. (Australia Branch) ABN 70003917655 AFSL 238446 (collectively referred to as, ‘Rabobank Australia’) recommend that you seek independent financial advice from your accountant or financial adviser before making any financial decisions related in any way to the contents of this publication. The information and opinions contained in this publication have been compiled or arrived at from sources believed to be reliable. Any opinions, forecasts or estimates made are reasonably held, based on the information available at the time of publication and there can be no assurance that that future results or events will be consistent with any such opinions, forecasts or estimates. All opinions expressed are subject to change at any time. No representation or warranty, either expressed or implied, is made or provided as to the accuracy, reliability or completeness of any information or opinions contained within the publication. You should make your own inquiries regarding the contents of this publication. Rabobank Australia does not accept any liability for any loss or damage arising out of any error or omission in the publication or arising out of any reliance or use of this publication or its contents or otherwise arising in connection therewith. This publication may not be reproduced or distributed in whole or in part, except with the prior written consent of © Rabobank Australia Limited ABN 50 001 621 129 AFSL 234700 and Coöperatieve Rabobank U.A. (Australia Branch) ABN 70003917655 AFSL 238446, as part of the Rabobank Group

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 37 countries, servicing the needs of approximately 8.4 million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 90 branches throughout Australia and New Zealand.

Media Contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com