06/03/2025

The global dairy market is poised for modest supply growth in 2025, driven by steady production expansion and export demand, according to a new report by food and agribusiness banking specialist Rabobank.

However, with the slow growth rate not expected to translate into surging stocks or general oversupply, global dairy prices look set to remain at elevated levels.

For Australia, the report says, dairy farm margins are poised to benefit from improving farmgate prices through 2025, high commodity returns and a softer currency.

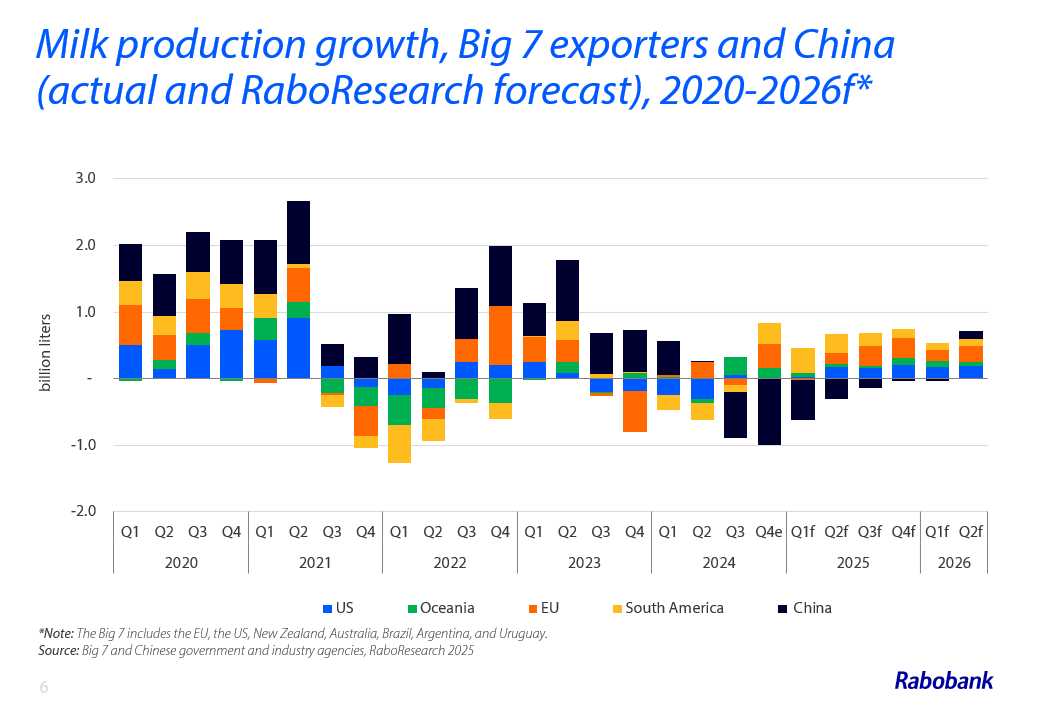

In its Q1 Global Dairy Quarterly report, titled Modest growth amid trade shifts, Rabobank says it expects milk production in the Big 7 dairy-export regions (the EU, US, New Zealand, Australia, Brazil, Argentina and Uruguay) to expand by 0.8% year on year (YOY) for 2025, with a similar gain in the first half of 2026.

The report says this forecast is driven largely by a return to production growth in both the EU, where production has oscillated between growth and contraction in recent quarters, and the US, where the typical annual production gains of 1% have stagnated in recent years.

“US supply expansion is expected in 2025, but it’s likely to be modest at sub-1%,” report co-author, RaboResearch senior dairy analyst Michael Harvey said.

RaboResearch senior dairy analyst Michael Harvey

“Production gains are also expected from Oceania and South America, largely driven by prior year declines that are easy to surmount. Overall, we anticipate milk production from the ‘Big 7’ will reach 325.8 million metric tonnes (mt) in 2025, up from 323.2 million mt last year.”

Mr Harvey said global supply growth was likely to be stronger in the second half of 2025 than the first.

“2025 will begin with slower production gains, estimated at 0.5% in Q1, which will help maintain the current firm commodity prices. We’re forecasting a steeper 0.9% YOY gain in the second half of the year, which is projected to push 2025 production past the previous peak in global annual milk production, which was 323.7 million mt in 2021,” he said.

China

Outside of the Big 7, Mr Harvey said, China was on a different milk production path to most regions across the world, with Chinese supply set to fall further in the year ahead.

“Chinese milk production dropped in 2024, following several consecutive years of significant expansion, representing a stark break from the recent trend,” he said.

“Fewer cows and the steeper-than-expected decline in Q4 2024 milk production led RaboResearch to reduce its 2025 Chinese milk production forecast, which is now down 2.6% YOY, marking the second successive year of lower milk production in the country.

“Early February Chinese farmgate milk prices were down 15% YOY in US dollar terms, discouraging any near-term incentive for farmers to increase production.”

The report says Chinese dairy demand is expected to improve this year, but at a slower pace, reflecting domestic economic challenges.

“Chinese dairy imports should also improve compared to a paltry 2024 sum,” Mr Harvey said.

“For years, the world looked to China as a barometer for demand, but as the country rapidly increased dairy self-sufficiency in the first few years of this decade, 2021’s record import year is a distant memory.”

Global demand

Despite China’s retreat from the global demand “stage”, the report says, purchasing in other key regions is encouraging.

“US cheese exports surged to a record high in 2024, with positive signs for this year. However, potential challenges could disrupt this outlook, primarily related to the rapidly evolving trade barrier landscape as the US shifts away from decades of global alignment,” Mr Harvey said.

With the new Trump administration in the United States, the report says, tariff implementation, and possible subsequent retaliatory tariff action from trading partners, could negatively impact US dairy exports.

“Dairy has not yet been negatively impacted by any disruption, but the threat remains serious,” Mr Harvey said.

To keep trade balanced and dairy prices supported this year, the report notes importers worldwide will need to keep an eye on consumer demand in the wake of recent inflation.

Australia

For Australia, the report says, despite milk production beginning to decline in late 2024, after seven months of the current season, overall production is 0.4% higher YOY.

Mr Harvey says production is weak in western Victoria and Tasmania, but remains strong in eastern and northern Victoria and in New South Wales.

“The outlook for milk production heading into the seasonal spring peak this year – and for the 2025/26 season overall – will be heavily dependent on rainfall and weather conditions,” he said.

The report says summer rainfall over many key dairying regions had been average or “worse”. Looking forward, it says, above-average rainfall is expected for parts of the east coast, with autumn being a critical period.

Mr Harvey said favourable autumn rainfall would support better feed supply outlook and support milk flows.

RaboResearch forecasts overall Australian milk production growth of 0.7% YOY for the 2025/26 season.

The report says Australian dairy exports had a very strong year in 2024.

“With slightly increased farmgate milk supply last year and higher export returns, export volumes were higher across the main dairy commodities,” Mr Harvey said. “Of the two largest volume trade flows, Australian cheese exports jumped 30% and skim milk powder exports lifted 27% YOY.”

Mr Harvey said the outlook for Australia’s dairy trade will be shaped by milk availability moving into the new season and “the seasonal flush” (the springtime peak of milk volumes).

“Export returns are likely to remain attractive, but milk supply growth (impacting supply availability for export) has slowed,” he said.

In terms of local demand, Mr Harvey said, with inflation continuing to trend lower and recent interest rate relief, this should provide a lift in discretionary consumer spending and a subsequent boost to foodservice demand.

RaboResearch Disclaimer: Please refer to Australian RaboResearch disclaimer here

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of more than nine million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 87 branches throughout Australia and New Zealand.

Media Contacts:

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: 02 8115 2744 or 0439 603 525

Email: denise.shaw@rabobank.com

Will Banks

Media Relations Manager

Rabobank Australia

Phone: 0418 216 103

Email: will.banks@rabobank.com