What are the changes?

In response to your feedback, we have made some improvements to our new Farm Business/Agribusiness internet banking.

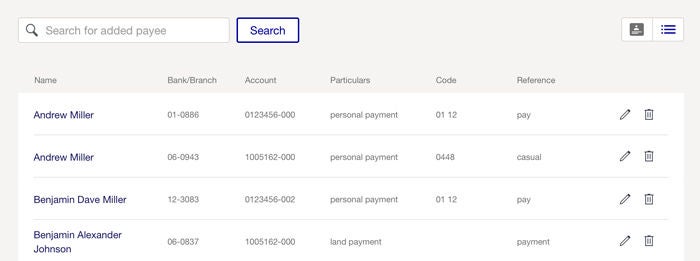

Payees as a list

Payees can also be shown as a list view. Simply select the list view option at the top right hand of the payees screen.

(Website only - not available on mobile app)

(please note names and account numbers displayed are samples only and not real customer data)

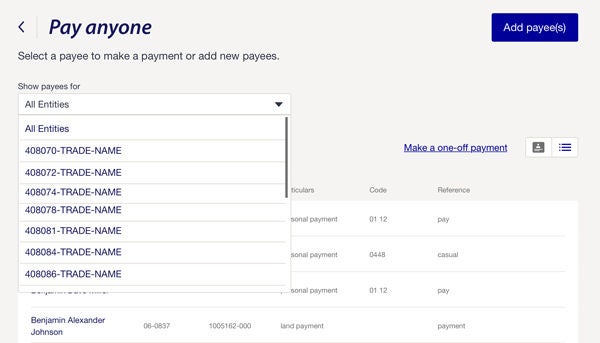

Payees for a specific entity

You can choose to view only the payees that belong to a specific entity.

(Website only - not available on mobile app)

(please note names and account numbers displayed are samples only and not real customer data)

Account balances on transaction confirmation screens

When printing transactions from the confirmation screen, account balances no longer show on the printed copy.

Formatting for transaction lists

We've improved the formatting and printing for transactions lists, which now take up less room on the screen and page.

Navigation

Now simple and easy and lays out your options in a more intuitive view.

Payments

No more separating payees and accounts when making payments (including batch payments). You can now access all payees and all accounts throughout the payment process.

When compiling a batch payment, you can select from all your payees, regardless of which entity/account/facility they are attached to, and select which entity/account/facility you want to pay them from, all in the one batch.

All batch payments will require authentication using your RSA token.

You can see your payments from the 'check payment page' or 'send for approval page' once you are done.

Fixed Rate Bookings

Fixed rates are fully disclosed. The all up rate, and the component parts are shown as part of fixed rate bookings.

You will see the all up rate at two points when making fixed rate bookings:

- Where the rate is shown, it will alert you that the rate includes the base rate and the margin combined.

- When you select a rate, the confirmation screen will show a breakdown of the all up rate and the client margin.

Notifications

By default, you will receive emails and notifications for all messages.

You can make changes to your notification preferences by going into services and settings, and selecting notification preferences.

Validation

Where you enter information that is not valid in that field, you will immediately be prompted by a red alert notice that the data is invalid. An example of this is where you put a letter in a number only field.

Payee Authentication

The ability to authenticate up to 10 payees at once.

Adding Payees

When you add a new payee, you will now receive a text message confirmation. If you add one payee, the text will show brief payee details. If you are adding more than one, details are not shown.

Managing Payees

There is no longer any need to copy payees between entities, since you can access them at all points, as per your account structure.

User Permissions

You can select the number of signatories, and specific delegates to authorise particular transactions, in line with your account requirements.

Text Confirmations For New Payees

If you add one payee, the message will give details of the payee added.

If you add 2-10 payees the message will alert you that payees have been added.

If you have not added payees, please contact our Customer Support centre immediately.

Daily Transaction Limits

Only external transfers count towards your daily transaction limits. No limits apply to transferring funds between your own accounts.

Templates from accounting software

You can no longer edit a template that has been imported from accounting software. Changes must be made before importing.

Fixed Rate Bookings

Fixed rates are fully disclosed. The all up rate, and the component parts are shown as part of fixed rate bookings.

You will see the all up rate at two points when making fixed rate bookings:

- Where the rate is shown, it will alert you that the rate includes the base rate and the margin combined.

- When you select a rate, the confirmation screen will show a breakdown of the all up rate and the client margin.

Mobile Navigation Tip: When setting up a fixed rate booking, once you have selected the rate you want, simply hit the 'back' (<) button at the top left-hand of the screen to return to the overview screen and complete your fixed rate booking.

One Off Payments

One off payments can be made to payees not on your list (RSA token needed).

* Most functionality from the website is now available on mobile, however some features are only available on the desktop, including batch payments.

* Mobile access is only available for account owners (not delegated users).

Temporary Loan Increases

Can now be viewed on mobile.

Your existing data has been migrated to the new platform.

Some data is not available:

- Secure messages. This is the way you have previously communicated with our Customer Service Unit through the website. Previous messages from the last 13 months have been transferred to the new platform. Messages older than 13 months have been archived. If you need to access these historical messages you can do so by contacting Client Support on 1800 025 484.

- Unapproved pending payments.

- Unauthorised payees. Where you have put in the details of a new payee, but have not authorised them using your RSA token.

- Automatic batch templates. This includes templates imported from accounting software that you have not edited.

- Batch templates (including draft templates) that have not been used in the last 390 days have not been migrated.

- Session summaries (usually available for 30 days) are only available on the website for actions from 27th July. This information is still available by calling Client Support on 1800 025 484.

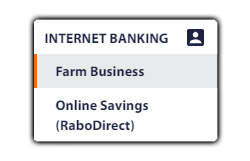

For Farm Business clients who also have Online Savings (RaboDirect) accounts, there are no changes to your Online Savings (RaboDirect) Internet Banking.

For further information and support:

or

What you need to do

Internet Banking (desktop)

Internet Banking (desktop)

You will need to access your desktop internet banking through the Rabobank.com.au website. The former URL for the login page will no longer work.

Simply choose Farm Business from the drop down Internet Banking link at the top right hand side of the screen.

You will pass through the notices page, then into the login page.

Login as you always have to access the new internet banking site.

Mobile App (phone)

You will need to delete your current 'Rabobank Australia' app and search for the new 'Rabobank AU' app in the App Store or Google Play, then click 'Install'. Instructions to delete an app for iOS can be found here, and for Android here.

The first time you use the app, you will need to authenticate using your RSA token and set up your pin number. After that you can use your mobile app as usual.

Follow three simple steps to start using the new app:

| STEP 1: Uninstall | Uninstall/delete your current 'Rabobank Australia' mobile banking app from your phone by pressing and holding the app until the icons begin shaking. Then tap the cross button on the top left of the app icon. |

| STEP 2: Download | Search for the new ‘Rabobank AU’ app in the App Store or Google Play and follow the prompts to install. |

| STEP 3: Start Using | Open and start using the app. Have your RSA token ready to register the app for first time use. |

For any further questions:

or